Food Inflation Heats Up to Highest Level in More Than 10 Years

Inflation is making itself at home in the American economy.

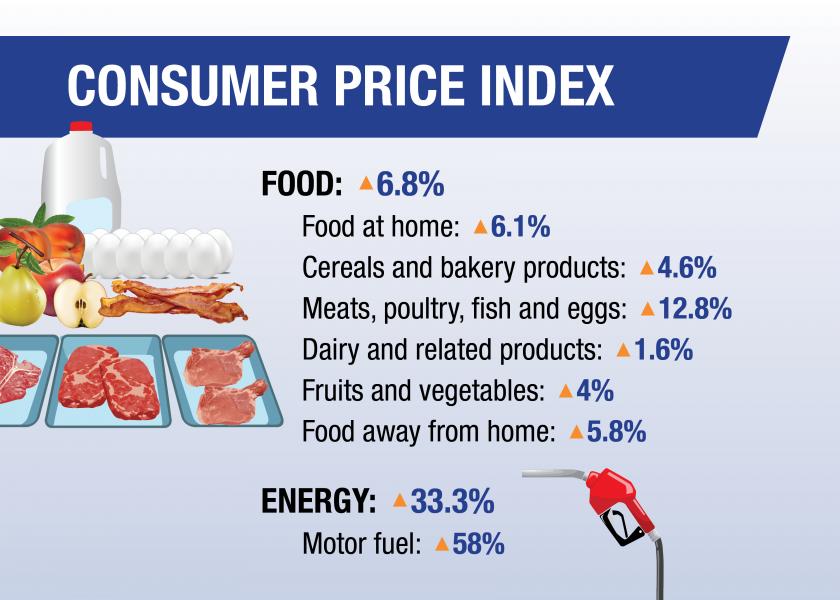

Consumer prices through November are up 6.8% compared with a year ago, according to the U.S. Bureau of Labor Statistics. The CPI for urban consumers rose 0.8% in November after rising 0.9% in October.

Price increases were reported with most component indexes, according to the report, with prices for gasoline, shelter, food, used cars and trucks, and new vehicles among the larger contributors to rising prices.

The energy index rose 3.5% in November as the gasoline index increased 6.1% and the other major energy component indexes also rose. The food index increased 0.7% as the index for food at home rose 0.8%, according to the report.

“We're going to be in this period for quite some time. I mean, even after once we get through the holiday period where all these consumers are buying things, and we have all these logistical problems, I don't think our problems end there,” said Tanner Ehmke, lead dairy economist with CoBank. “We've still got so many people have left the workforce, and that's going to be driving wage inflation. And that's going to be driving price inflation for quite some time. And that's a systemic problem that is not transitory. This is an economy that is trying to find its footing now.”

“I think the some of the commodity markets had already been embracing inflation prior to Federal Reserve Chair Powell even coming out and saying, ‘Yeah, I think this might be here for a while,’” says Mike North of ever.ag. “You had simple things like inflation indexes that were already trading at 3%. We didn't buy into the transitory argument.”

Food hikes

The food index rose 0.7% in November after climbing 0.9% in both September and October.

The food at home index increased 0.8 in November, fueled by increases in all six major grocery store food group indexes. November was the third consecutive month that all six increased, according to the report.

The indexes for other food at home and for fruits and vegetables both increased 1% in November, while the index for meats, poultry, fish, and eggs rose 0.9 percent in November.

Within that group, the index for pork rose sharply, increasing 2.2%, while the index for eggs declined in November, falling 2.7%.

The food at home index rose 6.4% over the past 12 months, the largest 12-month increase since the period ending December 2008, according to the BLS.

All of the six major grocery store food group indexes increased over the period. The index for meats, poultry, fish, and eggs increased 12.8% with the index for beef rising 20.9%, according to the report.

The index for dairy and related products posted the smallest increase, rising 1.6% over the last 12 months. The remaining major grocery store food group indexes posted increases ranging from 4% (fruits and vegetables) to 5.7% (other food at home).

The index for food away from home rose 5.8% over the last year, the largest 12-month increase since the period ending January 1982. The index for limited-service meals rose 7.9% over the last 12 months, and the index for full-service meals rose 6%.

Retail and consumer response

Though retailers push back against produce suppliers asking for higher prices, retail food prices are increasing based on escalating input and freight costs, said Craig Carlson, president of Chicago-based Carlson Produce Consulting. Grower costs could be up 20% to 30% compared with a year ago, he said.

“I think the buyers are much more educated on this and understand, that compared to other times, they are probably apt to go ahead and take on price increases,” he said. “But that doesn’t mean they are going to automatically take the whole thing.”

Within the fresh produce category, Carlson said consumers may not be able to notice price increases from week to week or month to month, as retailers can hide higher prices with fewer promotions or modest per pound price increases.

The best way for consumers to understand inflation, Carlson said, is when they realize that their grocery spend is now Y instead of X.

Consumers will notice if their food shopping trip that used to cost $65 is now $70 or $75.

If a consumer must limit his grocery expenses because of fixed income, he may choose to buy less expensive commodities or trade down to frozen or canned versions, Carlson said.