November U.S. online grocery sales up 6% from a year ago

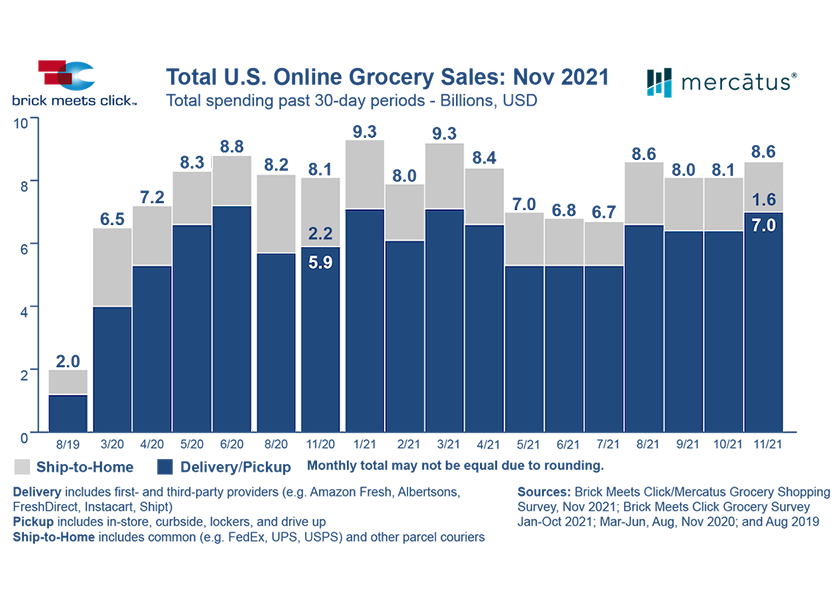

U.S. online grocery generated $8.6 billion in sales in November, including $7 billion from the pickup/delivery segments and $1.6 billion from ship-to-home.

The 6% sales gain over last year’s $8.1 billion was driven largely by a bigger active shopper base, especially in mass providers like Walmart and Target, according to the Brick Meets Click/Mercatus Grocery Shopping Survey fielded Nov. 29-30.

“Even as total online grocery sales increase, some conventional and regional grocers have reported softer sales performance during November, which is why looking at the broader eGrocery market is so important for identifying specific opportunities for improvement,” David Bishop, partner at Brick Meets Click, said in a news release.

“For example, not offering pickup is likely to weigh on sales growth. Failing to attract early-stage family households can affect growth prospects, and if the shopping experience isn’t comparable to mass rivals, that’s definitely hurting performance,” he said.

In November, almost 69 million U.S. households bought groceries online, whether a full basket of goods or just a few items, a 15% jump versus November 2020, according to the ongoing independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus.

One-third of these monthly active users (MAUs) are in the 30 to 44-year-old age group; this group has grown more than 25% since November of last year and now represents more than half of all MAU growth on a year-over-year basis.

Pickup’s dominance, which began in 2020 shortly after the start of the pandemic, continued. The segment grew dollar sales 29% versus last year, far outpacing delivery’s growth of 6% for the same period. Together, these two methods accounted for 81% of dollar sales in November 2021 compared to 73% of total sales a year earlier, while ship-to-home sales plummeted 27% in the past 12 months, reflecting changing buying patterns.

The average number of orders placed by MAUs in November 2021 dropped to 2.68, down 5% versus last November. All market types reported lower order frequency except for large metro markets, which held steady. However, the variability that monthly order frequency experienced during 2020 has lessened in 2021, declining by 60%, indicating that online grocery buying behaviors are becoming more entrenched.

The likelihood that a monthly active user will order again from the same online grocery service in the next month was down almost 25 percentage points compared to November 2020, when new COVID cases were higher and growing more rapidly, and vaccinations had yet to be administered.

The weighted average order value (AOV) across all three receiving methods was $71.12 in November 2021; this was driven by an AOV of $86.30 for delivery, $83.44 for pickup, and $42.03 for ship-to-home orders. Although spending per order dropped across all three segments versus last year, only ship-to-home saw its AOV dip below pre-COVID spending levels by 6% while AOVs for delivery and pickup each remained 15% or more above those levels.

The share of grocery’s monthly active users who also placed at least one online order with mass providers during November 2021 was 23.5%, a slight pullback versus the prior month but 280 basis point higher than last year. Part of November’s decline in cross-shopping may be related to the surge in MAUs buying from mass providers, which grew by 13 million households over the last 12 months. In contrast, grocery gained just over 4 million households.

The likelihood that a monthly active user will order again from the same online grocery service in the next month came in at 58.3% for November 2021, up 110 basis points from the prior month but down almost 25 percentage points compared to November 2020 when new COVID cases were higher and growing more rapidly, and vaccinations had yet to be administered. Throughout 2021, repeat intent rates performed within a tighter range, but at a lower level than the 2020 peak. This could cause headwinds for growing AOVs because spending per order typically increases between 6% and 20% as a customer uses a service more often.

Grocery’s repeat intent rates continued to lag those of mass retailers like Walmart and Target, and the gap grew from 4% the prior month to more than 9% for November 2021. This widening gap, along with a slightly lower cross-shop rate, may highlight reasons for grocers to be experiencing higher customer churn in their MAU base than mass retailers.

“Although the market that grocers compete in today is fundamentally different, my advice remains the same,” Mercatus president and CEO Sylvain Perrier said in the release. “Understand why your customers shop with you in-store and know what they value most from the experience. Take this insight, work with your online partners to emphasize your key points of differentiation online by offering a shopping experience that is tailored to the shopper’s purchasing preferences.”

Online grocery sales captured less than 2% of the total weekly grocery spending in the U.S. pre-COVID; now, as of November 2021, the share was seven times larger at almost 14% on a national level and remained between 11% and 15% throughout 2021.

The survey included 1,785 adults who participated in the household’s grocery shopping.