USDA Significantly Boosts Net Farm Income Forecast, Highest Since 2013

AgDay 09/03/21 - Net Farm Income Forecast

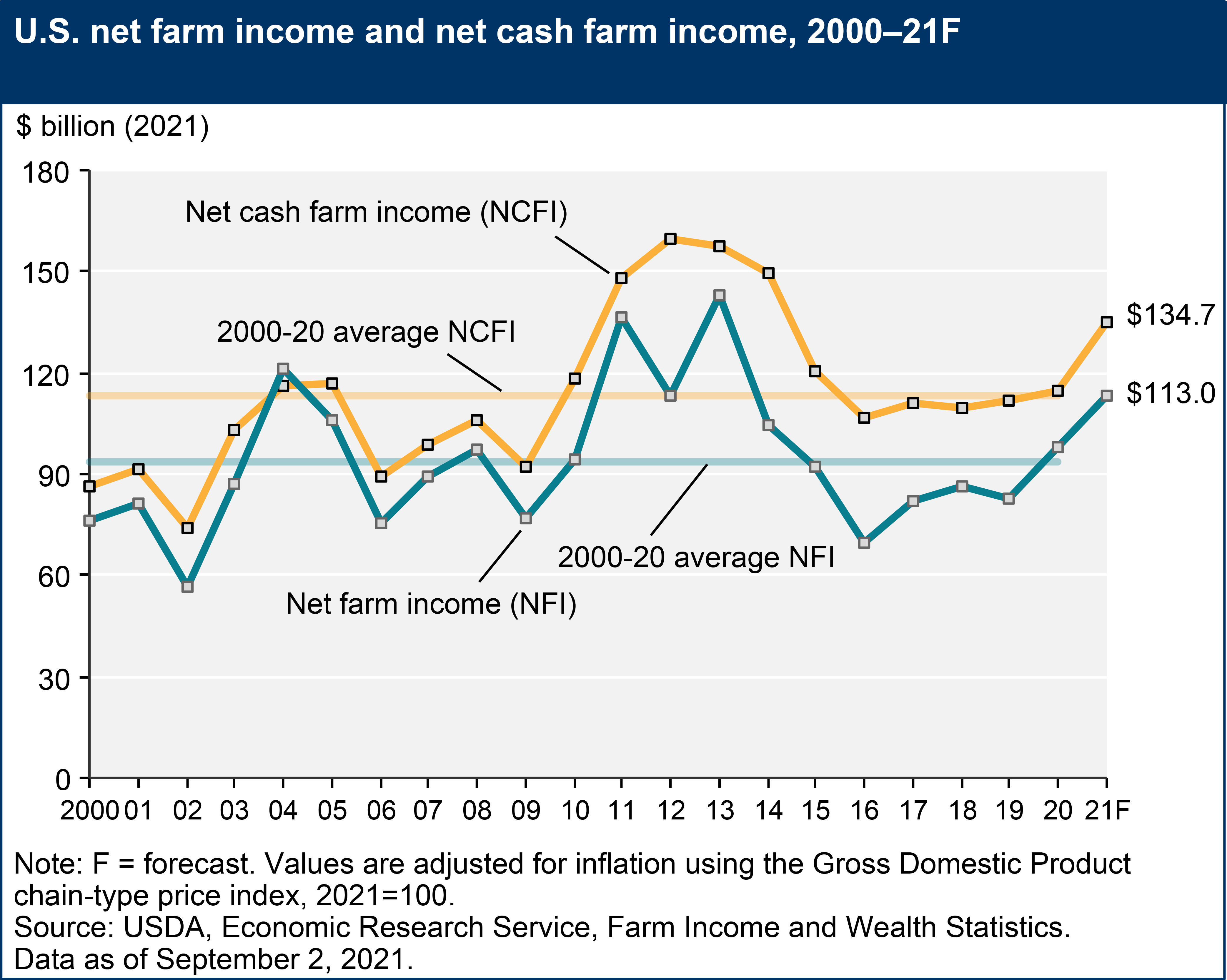

USDA's latest net farm income forecast paints an optimistic picture.

Net cash farm income, which tracks producers’ cash flow, is forecast by USDA at $134.7 billion for 2021. That number is up $6.4 billion from February’s forecast and would be an increase of 21.5% from 2020's $110.9 billion. As reported in February, ProFarmer indicated farm income forecasts were too low.

Highlights:

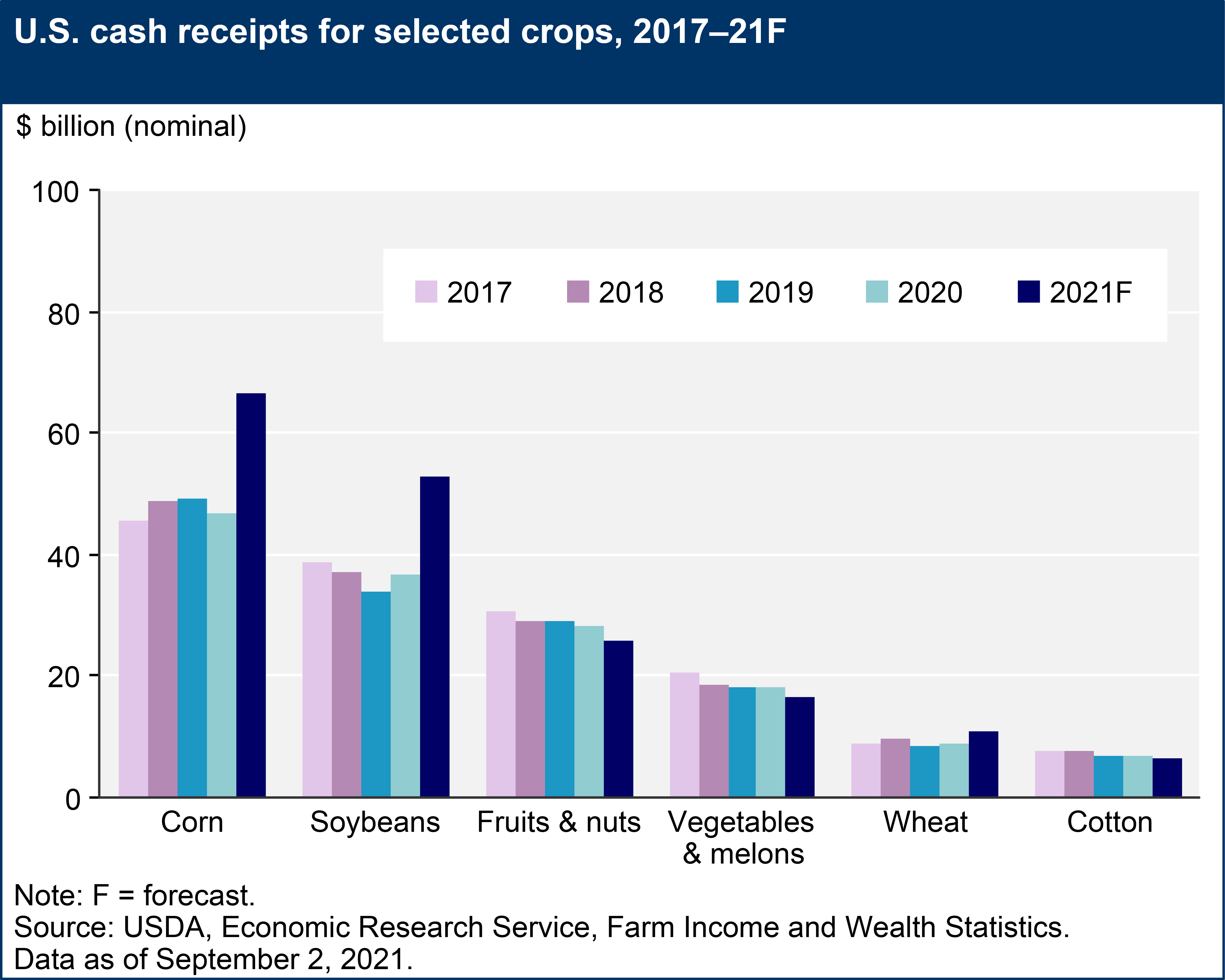

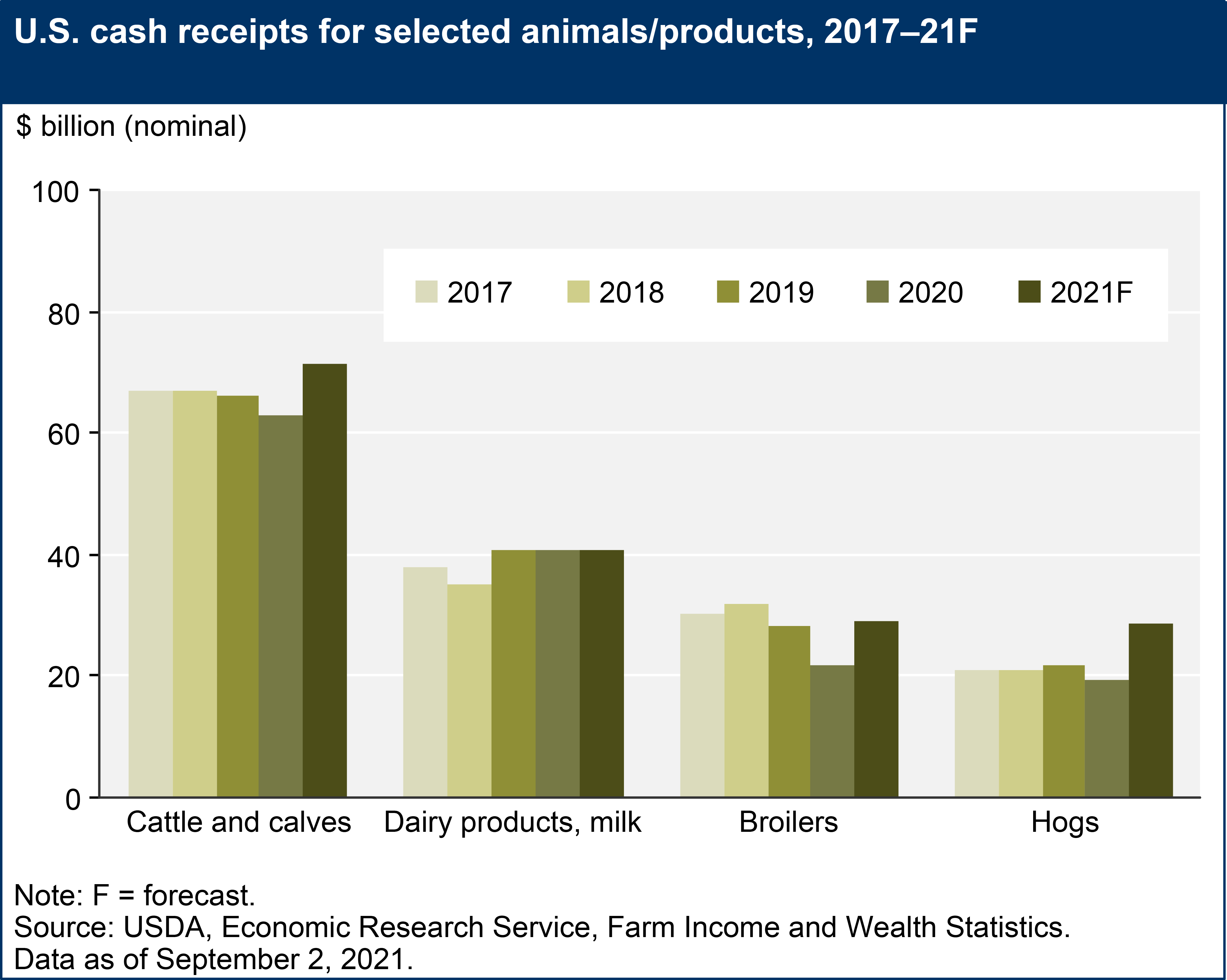

• Overall, farm cash receipts are forecast to increase by $64.3 billion (18.0 percent) to $421.5 billion in 2021 in nominal dollars. Total crop receipts are forecast to increase by $37.9 billion (19.7 percent) from 2020 levels to $230.1 billion. When combined, soybean and corn receipts are forecast to increase by $36.3 billion (43.6 percent) in 2021, accounting for most of the forecasted growth in crop cash receipts. Total animal/animal product receipts are expected to increase by $26.5 billion (16.0 percent) to $191.5 billion following increases in receipts for hogs, cattle/calves, and broilers.

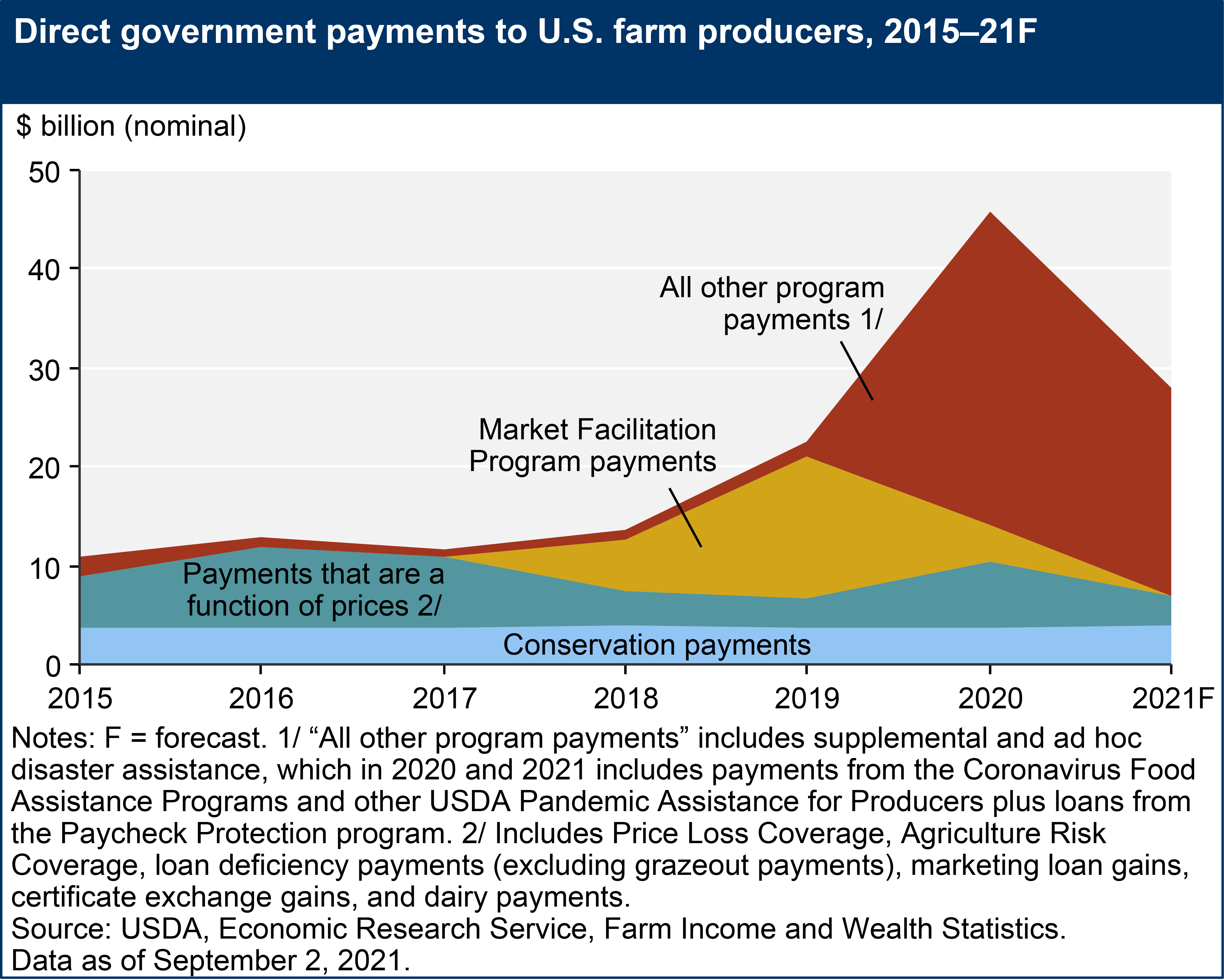

• Direct Government farm payments are forecast at $28.0 billion in 2021, a $17.7 billion (38.6 percent) decrease from 2020. Direct Government farm payments include Federal farm program payments paid directly to farmers and ranchers but exclude U.S. Department of Agriculture (USDA) loans and insurance indemnity payments made by the Federal Crop Insurance Corporation. Much of this decline is because of lower supplemental and ad hoc disaster assistance to farmers and ranchers for the coronavirus (COVID-19) pandemic compared with 2020 and closure of the Market Facilitation Program.

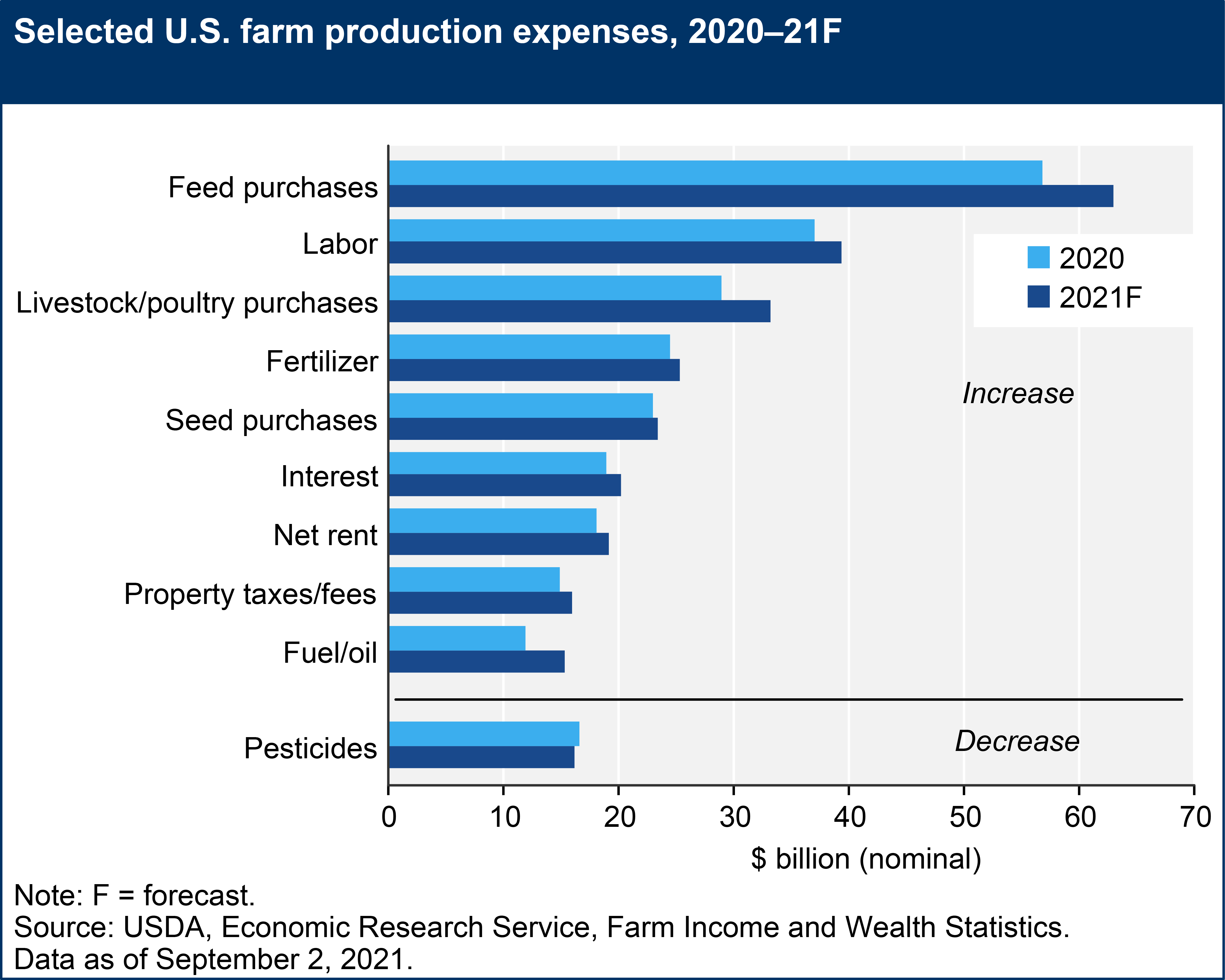

• Total production expenses, including expenses associated with operator dwellings, are forecast to increase by $26.1 billion (7.3 percent) in 2021 to $383.5 billion. Nearly all categories of expenses are forecast to be higher in 2021, with feed, livestock and poultry purchases expected to see the largest dollar increase.

• Farm sector equity is expected to increase by 2.9 percent to $2.81 trillion in nominal terms, a decline of 0.7 percent after adjusting for inflation. Farm sector assets are forecast to increase 2.5 percent in 2021 to $3.25 trillion following increases in the value of farm real estate assets. When adjusted for inflation, both total assets and farm real estate assets are forecast to fall by 1.2 percent and 1.7 percent, respectively. Farm sector debt is forecast to be relatively unchanged in 2021 at $443.9 billion in nominal terms but fall by 3.8 percent when adjusted for inflation. Real estate debt is forecast to rise but non-real estate debt is forecast to fall. Debt-to-asset levels for the sector are forecast to fall from 14.02 percent in 2020 to 13.64 percent in 2021, the first decline since 2012. Working capital is forecast to increase by 13.8 percent in 2021, after a decline of 6.0 percent in 2020.

Direct government farm payments forecast to decrease in 2021. Direct Government farm program payments are made by the Federal Government to farmers and ranchers with no intermediaries. Typically, most direct payments to farmers and ranchers are administered by USDA under the Farm Bill and other ad hoc programs. Government payment amounts do not include Federal Crop Insurance Corporation (FCIC) indemnity payments (listed as a separate component of farm income) and USDA loans (listed as a liability in the farm sector’s balance sheet). After reaching a record high of $45.7 billion in 2020, direct Government farm program payments are forecast to decrease by 38.6 percent ($17.7 billion) to $28 billion in 2021. This overall decrease reflects lower anticipated payments from supplemental and ad hoc disaster assistance, mainly direct payments from COVID-19-related assistance programs.

• Supplemental and ad hoc disaster assistance payments in 2021 are forecast at $21 billion, a decrease of $10.6 billion from 2020, primarily because of lower total payments for COVID-19-related aid.

— USDA Pandemic Assistance for Producers including the previous Coronavirus Food Assistance Program (CFAP) provides relief to producers whose operations are directly affected by COVID-19. Payments in calendar year 2021 from these USDA programs are forecast at $9.3 billion. In 2020, producers received $23.5 billion in CFAP payments.

— Payments from the Paycheck Protection Program (PPP), administered by the Small Business Administration, are forecast at $8.7 billion for 2021, compared with $6.0 billion in 2020. The PPP payments are designed to help small businesses keep their workers on the payroll. Although administered as a loan, the loans will be forgiven if the program's requirements are met. We treat these loans as a direct payment to farmers (assuming all recipients will meet the requirements and, therefore, have their loan forgiven). The forecast amounts may be revised as more data become available, with any unforgiven amounts ending up as farm debt rather than a direct payment.

• Farm bill commodity payments in calendar year 2021 under the Agriculture Risk Coverage (ARC) program are expected to be $6.7 million, a decrease of $1.3 billion from 2020 levels. Price Loss Coverage (PLC) payments in 2021 are expected be $2.2 billion, a decrease of $2.7 billion from 2020 levels. Note that 2021 ARC and PLC payments, if triggered, are for crop year 2020. Some of the relative decline in ARC and increase in PLC is because of a provision in the 2018 Farm Bill that permitted producers to change their program election (ARC or PLC) beginning with crop year 2020. Additionally, ARC payments are expected to decrease because of higher commodity prices and higher yields in 2020 compared with 2019 levels, particularly for corn and soybeans. PLC payments are expected to decrease because of higher prices for corn, soybeans, and wheat compared with 2019.

• The Dairy Margin Coverage Program replaced the Dairy Margin Protection Program in the 2018 Farm Bill. For 2021, this program is forecast to make net payments of $0.8 billion to dairy operators compared with $0.2 billion in 2020.

• Conservation payments from the financial assistance programs of USDA's Farm Service Agency and Natural Resources Conservation Service are expected to be $4.0 billion in 2021.

• Minimal residual payments of $42.1 million from the Market Facilitation Program (MFP) are included in our 2021 forecast. The payments are at much lower levels than 2018–20 because no new payments have been programmed by USDA.

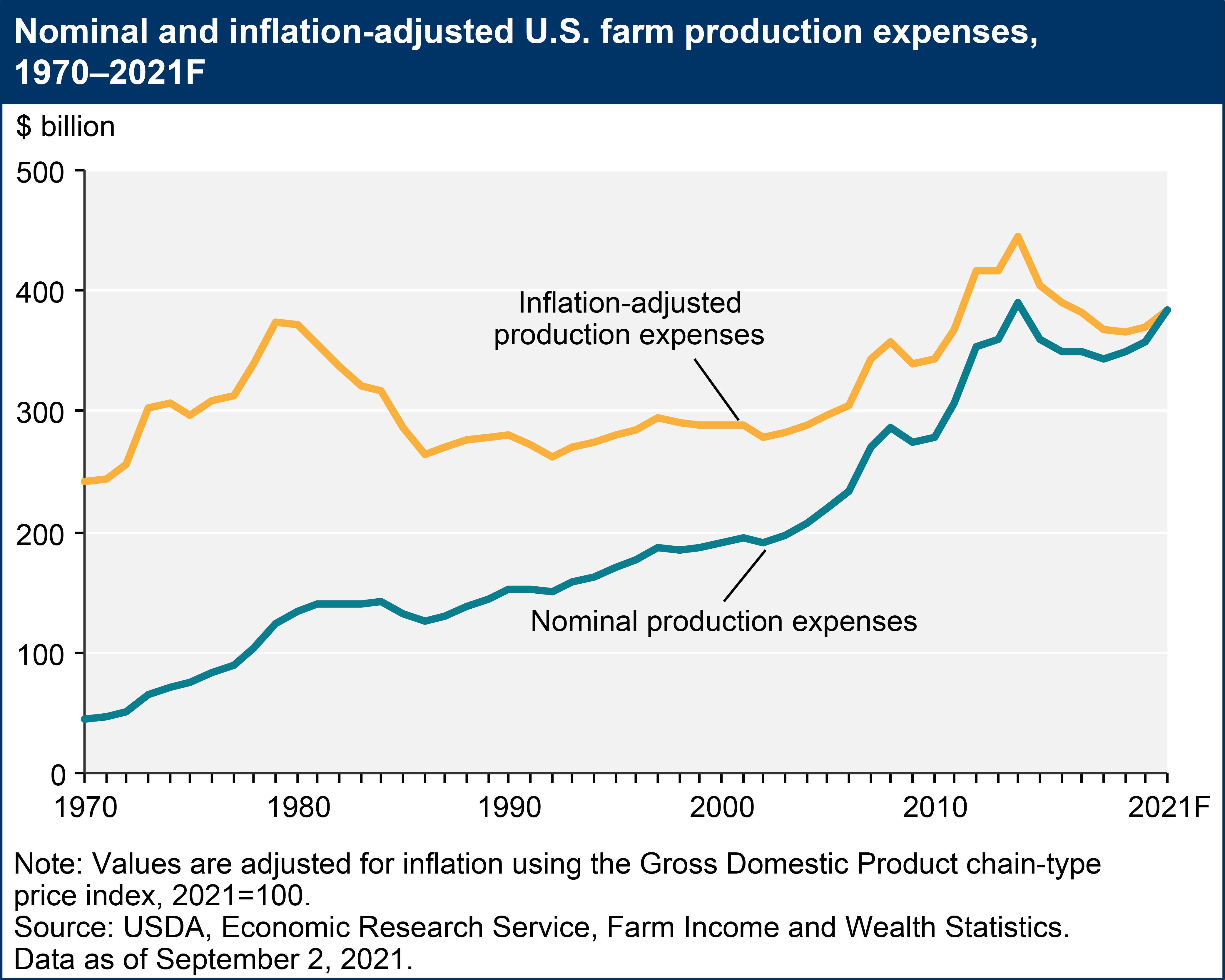

Production expenses forecast to increase in 2021. Farm sector production expenses — including expenses associated with operator dwellings — are forecast to increase by $26.1 billion (7.3 percent) from the previous year (in nominal terms) to $383.5 billion in 2021. Most expense categories are forecast to rise during the year. If this forecast is realized, production expenses would be the highest since 2016 yet below the 2014 peak in inflation-adjusted terms.

• Feed expenses, the largest single expense category, are forecast to increase by $6.2 billion (11.0 percent) in nominal terms to $63.1 billion in 2021, because of higher prices for feed commodities.

• Livestock and poultry purchases are forecast to increase by $4.1 billion (14.1 percent) to $33.1 billion.

• Fuel and oil expenses are projected to increase by $3.3 billion (27.1 percent) to $15.2 billion. This is partly driven by the U.S. Energy Information Agency's August forecast of higher diesel prices (up by 61 cents per gallon) in 2021.

• Overall, labor expenses are forecast to increase by $2.4 billion (6.6 percent) to $39.0 billion, because of an increase of $2.1 billion (7.1 percent) in hired labor expenses.

• Interest expenses are expected to increase by $1.3 billion (6.8 percent) to $20.3 billion, because of higher interest expenses on real estate debt.

• Net rent to landlords is forecast to increase by $1.1 billion (6.1 percent) in 2021 to $19.2 billion.

• Fertilizer-lime-soil conditioner expenses and seed expenses are expected to grow by 3.9 percent and 1.4 percent, respectively.

• Pesticide expenses, the only major expense category expected to decrease in 2021, are expected to fall by $0.3 billion (1.6 percent) to $16.3 billion.