U.S. fresh vegetable imports from Mexico and Canada continue to surge, USDA reports

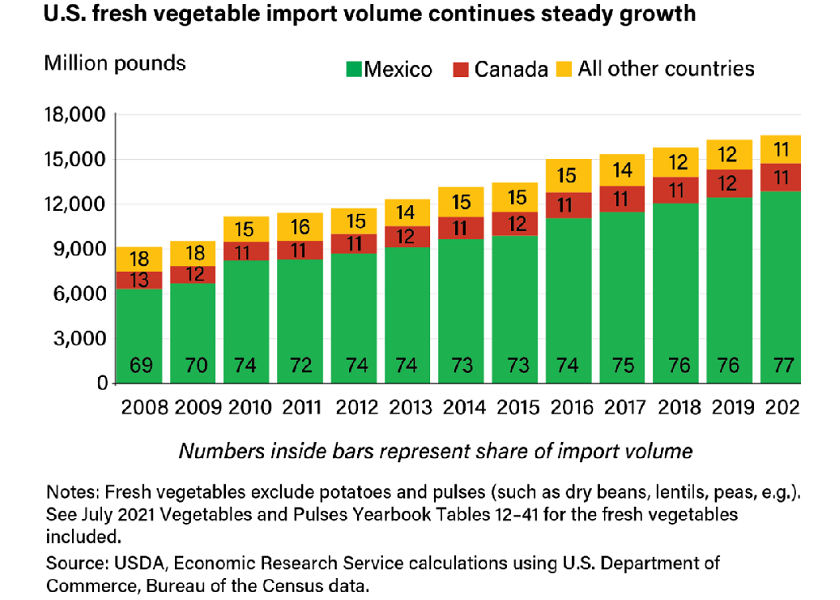

Over the past 20 years, the volume of fresh vegetables imported by the U.S., primarily from Mexico and Canada, rose nearly 200%, according to a new analysis from the U.S. Department of Agriculture's Economic Research Service.

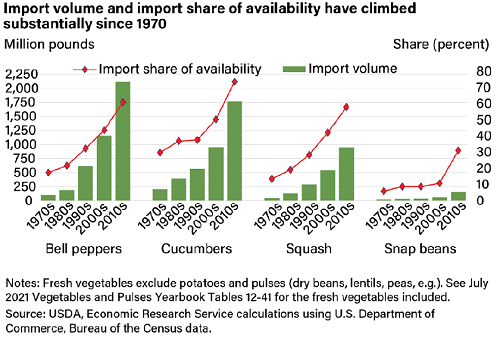

Authored by Wilma Davis and Gary Lucier, the USDA report said market window creep, liberalized trade agreements, comparatively lower foreign exchange rates, and increased per capita consumption have all combined to fuel annual increases in fresh vegetable import volume. The ERS report focused on bell peppers, cucumbers, squash, and snap beans, though the authors noted that imports are increasing across the fresh vegetable industry.

Import numbers

While the U.S. receives fresh vegetables from more than 125 different countries, the authors said Mexico and Canada dominate supply, with 77% and 11%, respectively, in 2020.

"An analysis of domestic census and trade data shows Mexican and Canadian producers have dominated the U.S. import market by offering protected culture—or greenhouse—imports as well as organic options, which increased choices for consumers," the report said. "While conventional and field-grown fresh vegetables still account for most imports, organic and greenhouse vegetables are expanding market reach."

U.S. consumers have pushed for greater consistency in supermarket produce and expanded demand for year-round availability of "virtually all" fresh vegetables, according to the report.

Market windows changing

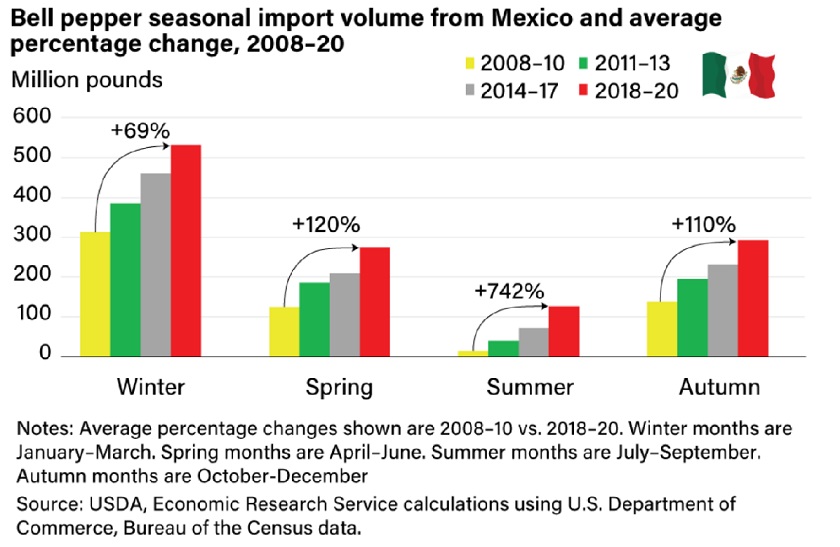

Market window creep also was examined in the ERS report.

"Over time, the categorization of vegetables into summer and winter categories has dwindled as near year-round imports of both categories of produce proliferated," the report said. As a consequence, the authors said many traditional domestic market windows have eroded in response to rising imports.

"Summer is historically the primary market window for U.S. producers; however, fresh vegetable import volumes from Mexico during the summer months have shown substantial increases in the past 15 years," the authors said.

For example, bell pepper import volume increased by 742% to 127 million pounds in the summers of 2018–20 from 15 million pounds in the summers of 2008–10, according to the report.

In the same way, the report said cucumber imports increased 156% to 223 million pounds from 87 million pounds over the same period; squash imports increased 105% to 69 million pounds from 34 million pounds; and snap bean import volume increased by 204% to 15 million pounds from 5 million pounds.

Market windows also are expanding for Canadian vegetable shipments to the U.S., according to the report.

The paper said a comparison of 3-year average import volume for bell peppers from Canada shows volume in the summer months increased by 79% percent from 2008–10 to 2018–20.

Cucumber imports from Canada increased 149% (to 162 million pounds from 65 million pounds) in the same period, according to the report. Squash imports increased 355% (to 14 million pounds from 3 million pounds); and snap bean imports increased 114% (to 3 million pounds from 1 million pounds), according to the report.

Mexico remains the leading foreign source and year-round supplier of fresh bell peppers, cucumbers, squash, and snap beans and accounts for about 80% import volume during 2018-20 for all four commodities.

Protection or not

The USDA ERS report said the impetus of the research effort was influenced by formal inquiries from U.S. vegetable producer groups presented to the U.S. International Trade Commission in November and December 2020.

U.S. producer groups for bell peppers, cucumbers, and squash filed inquiries with USITC to determine whether some type of relief was warranted with respect to unfair trade practices, according to the report.

The USITC submits a report at the end of each investigation. The cucumber and squash reports are scheduled to be delivered in December 2021, the authors said.

With long-term trends in place, the authors said more of the same could be expected in coming years.

"Market window creep, liberalized trade agreements, comparatively lower foreign exchange rates, and increased per capita consumption have all combined to fuel annual increases in fresh vegetable import volume," the authors said. “Given persistent decades-long trends, import gains as a portion of total supply are expected to continue within the fresh vegetable industry."