Online grocery sales in March shrink 6% compared to last year

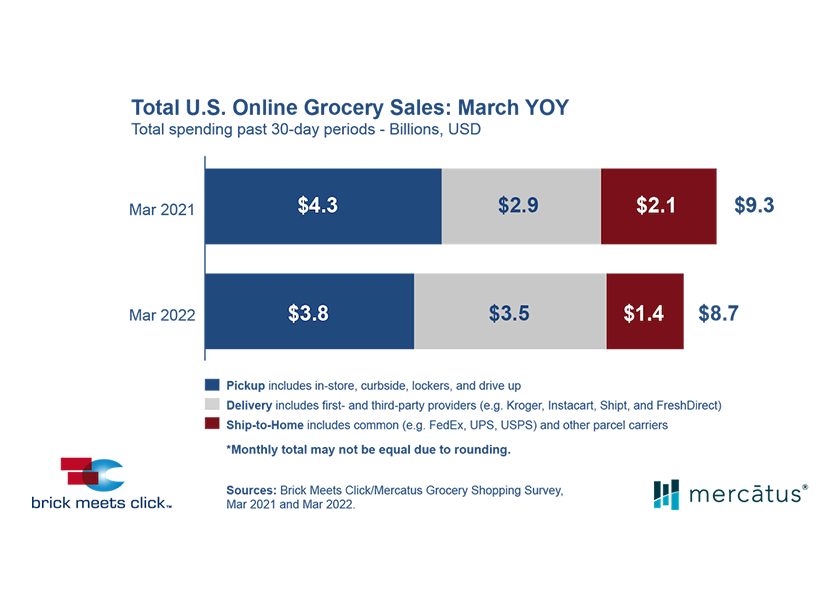

In March, total U.S. online grocery sales diminished to $8.7 billion from $9.3 billion in March 2021 — a 6% decline, according to the Brick Meets Click/Mercatus Grocery Shopping Survey fielded March 28 and 29.

But total sales for 2022’s first quarter finished 2.5% lower compared to a year ago, according to a news release.

This ongoing independent research initiative is created and conducted by Brick Meets Click, the analytics and strategic insight firm for grocery businesses, and sponsored by Mercatus, a grocery digital solutions company.

March year-over-year performance across the three e-grocery segments continued to change as the online grocery market evolves.

- The ship-to-home segment experienced the largest sales drop, plummeting more than 30% in March compared to a year ago, from $2.1 billion to $1.4 billion. The decline was driven by 13% fewer orders placed by monthly active users, combined with a 23% drop in the average order value.

- Pickup sales declined almost 11% in March from $4.3 billion in 2021 to $3.8 billion in 2022, affected by similar factors but to different degrees. Order frequency for pickup dropped 8%, while average order value dipped less than 4% versus the prior year.

- Delivery reported strong sales growth for March, surging more than 20% on a year-over-year basis from $2.9 billion to $3.5 billion. The number of orders placed by monthly active users climbed by 13% and average order value rose 7% versus March 2021.

“Two factors continued to drive delivery’s strong performance in March,” Brick Meets Click Partner David Bishop said in the release. “First, the aggressive expansion of third-party providers into grocery is enabling additional ways for people to shop online, and second, newer services focused on faster cycle times are appealing to a broader range of trip missions and usage occasions,” he added.

Cross-shopping between grocery and mass retailers (such as Walmart and Target) gained momentum as the share of grocery’s monthly active user base that also shopped online with mass retailers during the month increased nearly 4 percentage points compared to last year, finishing at 29% for March 2022.

The likelihood for an online grocery shopper to use the same service again within the next month also increased during March, climbing to almost 64%, up 1.4 percentage points on a year-over-year basis. Analyzing month-over-month results showed that March repeat intent rates at mass providers improved 8 points, while grocery’s intent rates lost more than 5 percentage points versus February 2022.

On a quarterly basis, total e-grocery sales for the first quarter of 2022 were just 2.5% lower versus the first quarter of 2021, with ship-to-home down 29%, pickup down 2% and delivery up 15%. Ship-to-home ceded 6 points of market share to delivery, while pickup, the dominant segment, held steady. During the first quarter of 2022, ship-to-home finished with 17% of e-grocery sales, while pickup’s share remained essentially unchanged at 46% and delivery accounted for 38%.

“A key takeaway from March’s report is that online grocery sales have retained much of the gains from a year ago, proving the resilience of grocery e-commerce,” Mercatus President and CEO Sylvain Perrier said in the release. "Even so, conventional grocers need to develop and strengthen their first-party web and mobile channels, leverage third-party solutions to fill in the gaps, and excel at executing the services they offer.”

In terms of share of wallet, total e-grocery finished the quarter at 13.1%, down from 13.7% last year. Excluding ship-to-home (since most conventional grocers don’t offer this service) reveals that the combined delivery and pickup share has grown about 40 basis points, accounting for 10.9% of total grocery spending during the first quarter.