Inflation the likely cause in April’s e-grocery sales drop

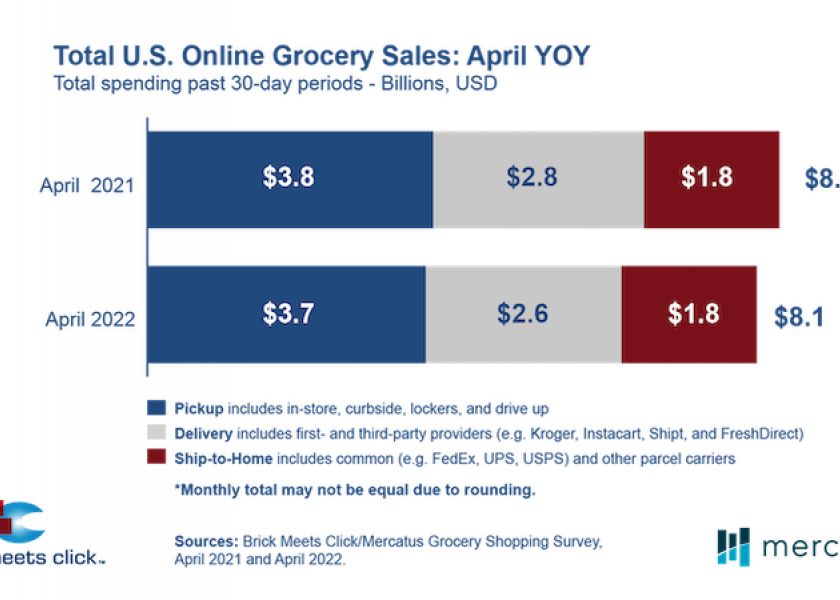

April online grocery sales dipped 3.8% compared to the same month last year, finishing at $8.1 billion, and the reason could be people are ordering online less frequently and some monthly active user base have quit grocery shopping this way.

The total order volume dropped 5.8%, according to a news release about the Brick Meets Click/Mercatus Grocery Shopping Survey fielded April 28 and 29.

“It’s no surprise that inflation is affecting where and how people shop online for groceries,” Brick Meets Click Partner David Bishop said in the release. “Some customers may now find pickup a more attractive service, since it can help them avoid the higher incremental costs associated with delivery, and others may choose to simply move more of their transactions back into the store.”

Delivery

Delivery-related sales, which accounted for almost one-third of total online grocery sales during April, dropped nearly 6% versus a year ago and contributed nearly half of the decline in total sales year-over-year.

But price inflation is likely why the delivery segment’s average order value jumped 6%, to $84 versus April 2021. That value jump helped mitigate an 11% decline in order volume that was mainly driven by the monthly active user base that contracted nearly 9% in the last year.

Ship-to-home

Ship-to-home, the smallest segment with just over one-fifth of the sales in April, fell more than 3% versus last year. Order volume drove the decline, dropping nearly 6% versus April 2021, while the average order value increased by almost 3% to $47. The decline in order volume was related to the monthly-active-user base drop of more than 2%, as well as those users receiving 4% fewer ship-to-home orders during the month.

Pickup

Pickup, the largest e-grocery segment with almost half of total sales, declined by less than 3% versus the prior year. Unlike the other two segments, pickup reported a nominal drop in average order value of about 70 basis points to $81; this, combined with a 2% drop in order volume, contributed to the year-over-year decline in sales. Versus April 2021, pickup’s monthly-active-user base shrank by less than 3% and order frequency among its those users was essentially unchanged.

Reasons

The evidence suggests that today’s customers are more likely to be concerned about the impacts of inflation than contracting COVID-19, according to the release.

Analyzing responses from March and April 2022 related to a monthly active user’s most recent online order found that mass-retail customers were 34% more likely than grocery customers to indicate that cost was the most important factor in deciding where to buy groceries online. When it came to how online grocery orders were received, pickup customers who used grocery or mass retailers were 18% and 11% respectively more likely to cite cost as the primary consideration when compared to delivery customers.

Despite the year-over-year drops in both order volume and the monthly-active-user base, the degree of cross-shopping between grocery and mass rose more than 40 basis points versus April 2021. The share of grocery’s user base that also shopped online with mass for groceries during the month finished at 24.2%.

The likelihood for an online grocery shopper to use the same service again within the next month increased during April, coming in at almost 63%, up almost 8 percentage points on a year-over-year basis. Analyzing month-over-month results showed that April’s repeat intent rate for mass-retail providers slid nearly 3 points while it climbed 50 basis points for grocery.

“With budget-conscious consumers naturally gravitating towards lower cost online services like pickup, grocers need to find ways to offer these services profitably and remain competitive,” Mercatus President and CEO Sylvain Perrier said in the release. “Conventional grocers can take advantage of more efficient pick-and-pack practices. They can also use tiered pricing models and variable fee structures to offset the cost to serve while still providing a compelling pickup experience to customers.”

In terms of share of wallet, total e-grocery finished April at 12.3%, down slightly from last year’s 12.7%. Excluding ship-to-home (as most conventional grocers don’t offer this service) the combined delivery and pickup segments finished the month at 9.6%, down about 30 basis point versus 2021.