Truck rates muted for now but could roar in weeks ahead

Despite sky-high diesel fuel costs, the USDA in late May reported generally adequate truck supplies for most produce growing regions and truck rates that are generally below year-ago levels.

That could change in the coming weeks, as produce volume will increase seasonally and domestic demand for transportation is likely to increase, one trucking analyst said.

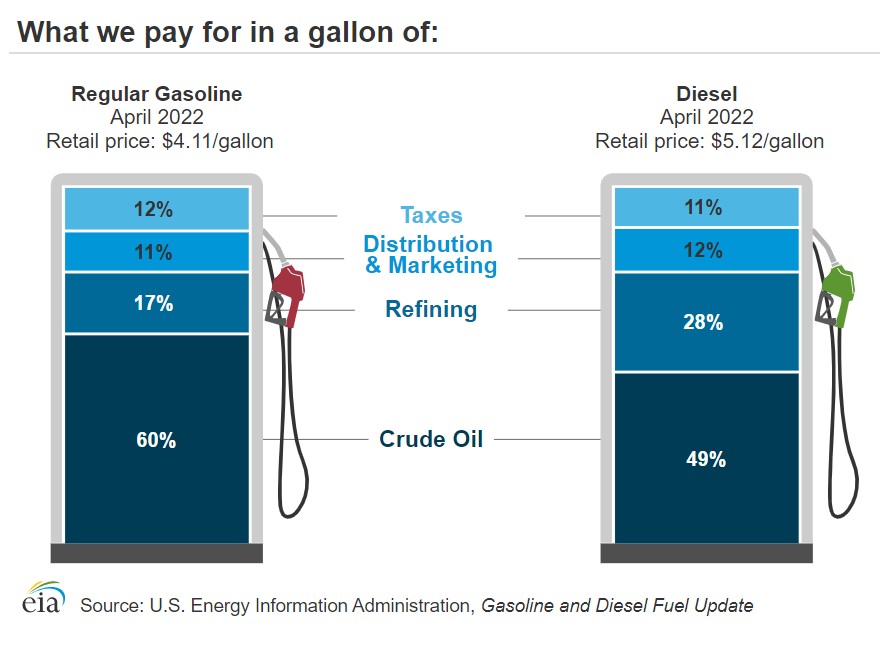

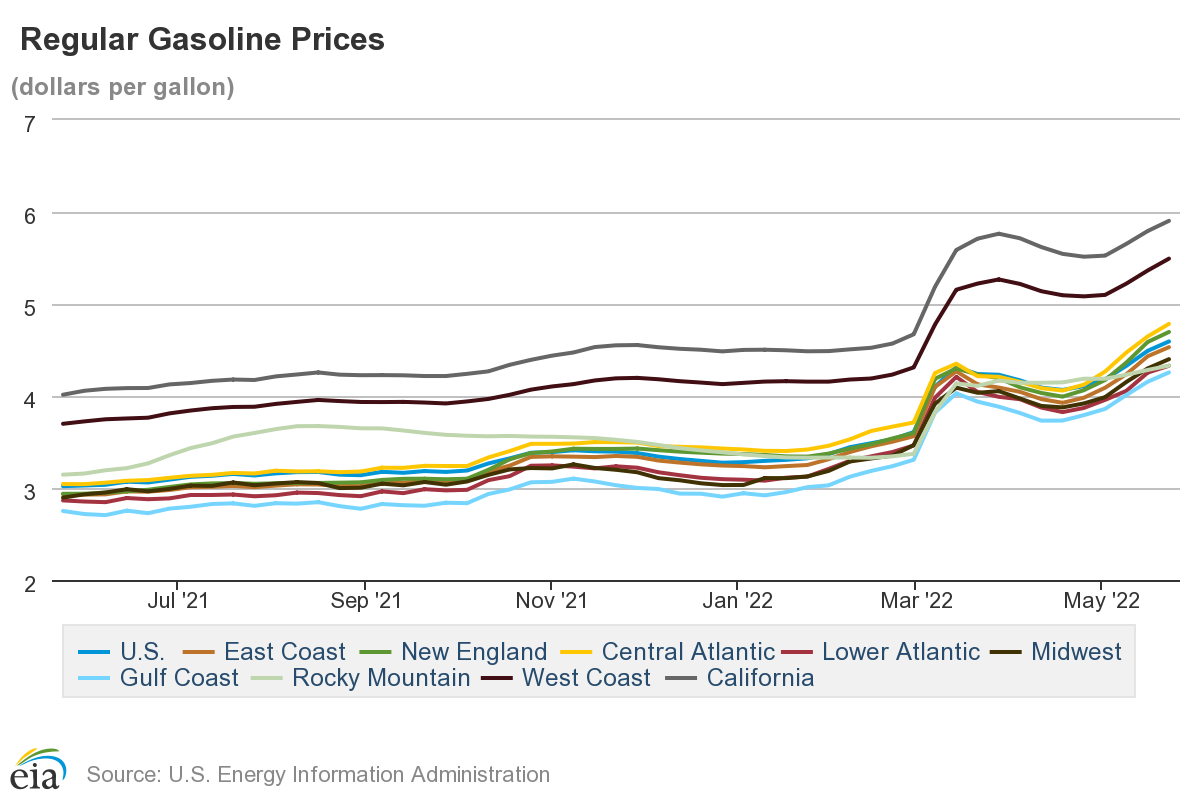

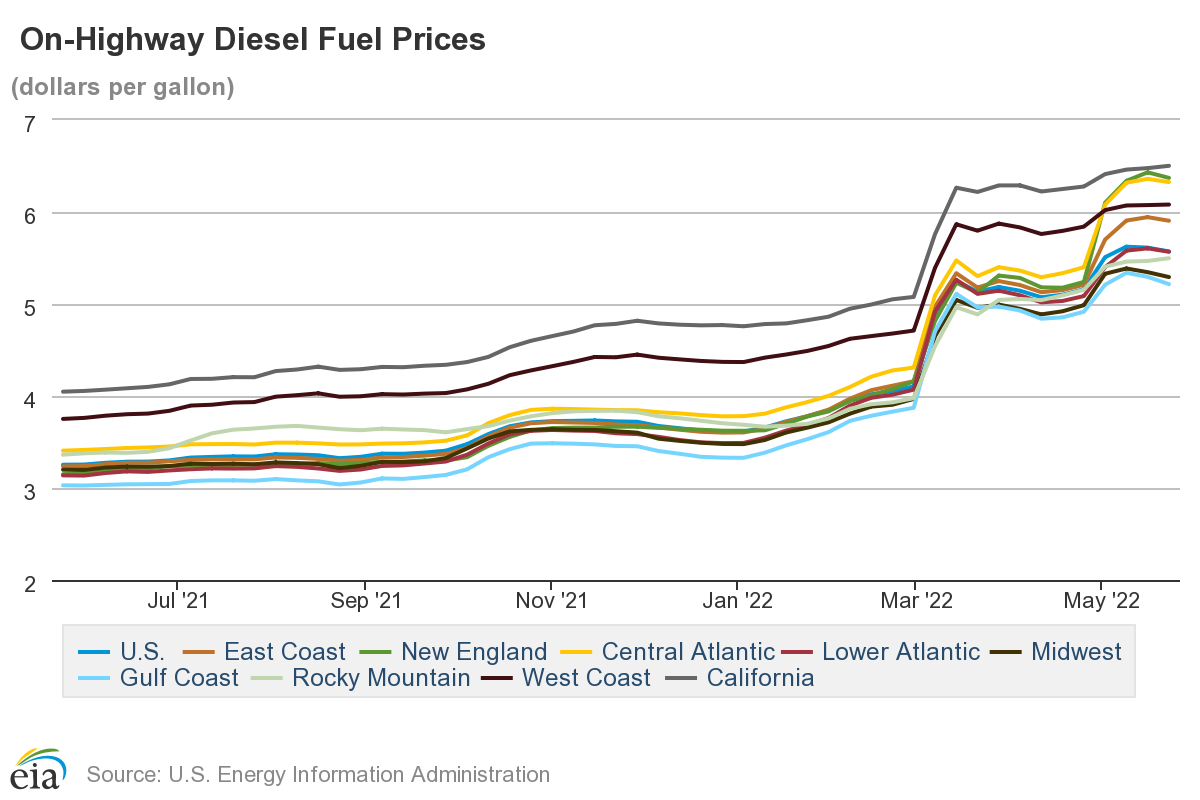

Diesel prices were hitting record levels in late May.

The U.S. Energy Information Administration reported the average U.S. price of diesel fuel on May 23 was $5.57 per gallon, up from a monthly average of $3.21 per gallon in May a year ago and more than double the $2.39 per gallon average in May 2020.

USDA-reported spot truck rates didn’t seem to reflect the peaking fuel market.

For Mexican produce crossings through Nogales, refrigerated truck rates to Los Angeles on May 24 (inclusive of fuel) were reported by the USDA at $1,600 to $2,000, with adequate availability of trucks reported.

A year ago, the USDA reported a shortage of trucks for the Nogales to Los Angeles lane, and rates between $2,400 to $3,600 per load.

Rates from Nogales to Philadelphia were reported May 24 this year at $7,300 to $7,900, down from $9,400 to $11,000 per load a year ago. Likewise, the USDA reported truck rates from California's Santa Maria were generally below year-ago levels.

While outbound truck rates from Santa Maria for May 24 were generally up between 2% and 4% compared with the previous week, freight rates were running below year-ago levels.

With adequate truck supplies reported, the USDA said on May 24 that rates from Santa Maria to Atlanta ranged from $7,000 to $8,900, down from $8,900 to $9,900 a year ago.

Truck rates from the Santa Maria district to Philadelphia were reported at $8,400 to $10,400, down from $10,400 to $11,300 the same time a year ago.

Heading higher?

Dean Croke, the principal analyst at freight platform DAT Solutions, said he believed the reasons for stable to softer rates compared with a year ago, in the face of record-high diesel prices, relate both to the volume of shipments and increased trucking capacity.

The USDA has reported lower truckload volumes for U.S. fruits and vegetables compared with a year ago, he said.

The USDA reported domestic fruit and vegetable shipments for the week ending May 21 totaled 25,889 40,000-pound truckloads, down about 20% from 32,437 domestic truckloads the same week a year ago. Import produce shipments for the same week were 24,804 truckloads, the USDA said, up 2% compared with 24,245 import truckloads a year ago.

Combined produce loads the week ending May 21 totaled 50,693 truckloads, down from 11% compared with a year ago.

Croke also said there is more truck capacity in the market, which has translated to lower spot rates despite higher fuel prices. “There are more trucks in the market, and you combine that with a slower start to the produce season, and you’ve got excess capacity in a lot of these big markets like the Southeast and in Fresno, Calif. on the West Coast,” he said.

The line haul rate for refrigerated loads is down 82 cents per mile (excluding fuel) since the start of the year, but fuel surcharges have doubled.

“When you look at refrigerated truck rates, year over year, including fuel, they're about the same,” Croke said, noting that the rate per mile, inclusive of fuel, was $3.05 per mile in late May, similar to a year ago.

With increasing domestic produce output, Croke said the market could be primed to increase in the weeks ahead, from Memorial Day through the Fourth of July holiday.

“I think the slow start to the season has created this excess of capacity in all of our produce markets,’’ he said. Because carriers intuitively position their trucks in those markets in anticipation of seasonally increasing volume, the ample supply of trucks has been met with less than expected demand so far, he said.

In addition, Croke said higher contract truck rates are resulting in fewer loads for the spot market. “There's a higher percentage of loads moving under contract and that sucks volume out of the spot market and rates decrease,” he said.

Normally, late May through the Fourth of July period sees an upward trend in the spot rate for refrigerated trucks. With the slower start to U.S. crop volume, Croke said the trend may unfold differently this year.

And while consumers may be cutting back on some purchases because of inflation, Croke said consumers will continue to consume fresh produce, frozen food and meat. That will keep demand for refrigerated trucks strong.

Record diesel prices – Croke noted late May average prices for diesel at $6.37 per gallon in the Northeast – will provide upward pressure for rates.

On the other hand, smaller carriers in the spot market may not be able to get the full fuel surcharge from their customers, he said, and that puts them at a disadvantage.

“These are perilous times for a lot of the carriers that don't understand their operating costs,” he said. “When there are too many trucks looking for loads, it’s hard to say I need another $100 more to cover fuel, when there is another guy lined up, ready to say, ‘I'm happy to take it for whatever you want to give me.’ That's the cycle we're in."