Produce retail data shows entertaining is back, but it’s complicated

SCHAUMBURG, Ill. — Produce retail data from the first half of 2022 shows trends in the marketplace that can be used as opportunities for growth, as well as solutions for the industry’s ongoing challenges.

“First of all, I would say, absolutely, entertaining is back — entertaining mostly at home. Life is still very home-centric,” said Anne-Marie Roerink, founder and principal of 210 Analytics, a market research firm. “But the roller-coaster ride continues.”

The produce retail market has been facing new factors added to the COVID-19 pandemic disrupters of the last couple years:

- The omicron variant peaked early in the year;

- Prices are up 10%;

- Supply chain issues worsen;

- War in Ukraine with Russian sanctions; and

- Gradual re-engagement with restaurants.

Roerink explained a dizzying amount of data that she compiled from multiple sources in a presentation she led with Joe Watson, vice president of retail, foodservice and wholesale at the International Fresh Produce Association. Their joint presentation opened the association’s Retail Conference June 9-10, in Schaumburg, Ill.

While some people are still working from home more than before, community events, evening sports and travel have all picked up significantly.

“So, convenience has become extremely important yet again,” Roerink said.

Optimized transactions and shopper baskets show that entertaining, convenience and on-the-go produce products — such as melons, salad kits, mixed fruit and party trays — are selling the most, according to IRI Integrated Fresh data from the last 52 weeks ending March 27.

Retail profit leaders optimize, rather than eliminate, produce shrink at an average of 7.5%, Roerink said, in several ways:

- Measure, track, analyze and report;

- Measure shrink at retail versus cost;

- Incentivize for shrink control;

- Speed-to-shelf, stock-keeping unit rationalization and production planning; and

- Involve everyone from clerks to receiving to store managers.

Profit leaders are great at managing shrink, which directly improves the bottom line. They measure, track, analyze and report their shrink. Getting the produce from the field to the shelf fast, and the correct produce, was key to managing shrink, which requires good relationships with grower-shippers.

Retailers can use the tactics of other store departments to manage shrink, such as offering deep discounts on produce just before it’s about to be tossed, the way bakeries offer buy one, get one free doughnuts an hour before they will be trashed, or the hot food bar offers 25% off between 7 and 8 p.m.

But those last-gasp produce items could be touted in different groupings, in boxes, labeled “Zero Waste Program,” with verbiage saying it tastes great but just doesn’t look so good. It’s reminiscent of the Misfits Market and Imperfect Foods ethos, but found in-store.

Related: Retailers share at International Fresh Produce Association’s Retail Conference

While shrink is quite the contender of top concerns, sales still should be up there, too, they said. And 81% of shoppers would like to see new varieties, the studies showed.

“It’s the newness, the idea of delighting people in the store. That's really where we see a lot of that new sales coming from,” Roerink said. “When we look at the numbers, it's always the old varieties that really cemented the sales, but those new dollars do tend to pounce on that newness. We can delight and surprise people.”

A Datassential report showed 75% of consumers were looking for new innovation in products in 2022, Watson said.

“How do we do that when many sales calls are still not being made? How do we get this presentation in front of the buy side, so they can make those decisions on what they're going to offer in your stores?” he said.

Executing production plans can be hard when retailers don’t always know what’s coming on the truck or what it will look like, but profit leaders take advantage of produce opportunities found at holidays and self-created special events centered on meat.

Americans spend nearly $5 billion on grillers and smokers, and they plan to use them this summer, Roerink said.

“We can really work together more, produce and meat, hand-in-hand, and drive some of that growth,” she said.

High-profit leaders also have a lot of labor hours. Yet, companies all along the supply chain are struggling to find enough labor.

The U.S. Bureau of Labor and Statistics found that quit rates are almost matching the level of job openings. It can help hiring managers to use more than salary to find and retain workers because salary is not the only key motivation for millennials quitting, Roerink said. Almost as important is job flexibility, including the ability to choose the days and hours of when they work.

Inflation

A comparison of produce dollars versus volume shows that produce dollars have been tracking below year-ago levels since that first quarter of 2021.

“More and more, this year is starting to look like 2019,” Roerink said. About “92% of consumers feel that grocery prices are some, or a lot, higher, and of those people, 95% are somewhat, or very, concerned about it. That's not the level that you often see.”

Fresh produce price inflation is in line with the higher prices found in the rest of the store, although higher than frozen produce, according to IRI Integrated Fresh data. That's a competitor.

Related slideshow: See IFPA's Retail Conference golfers out on the green

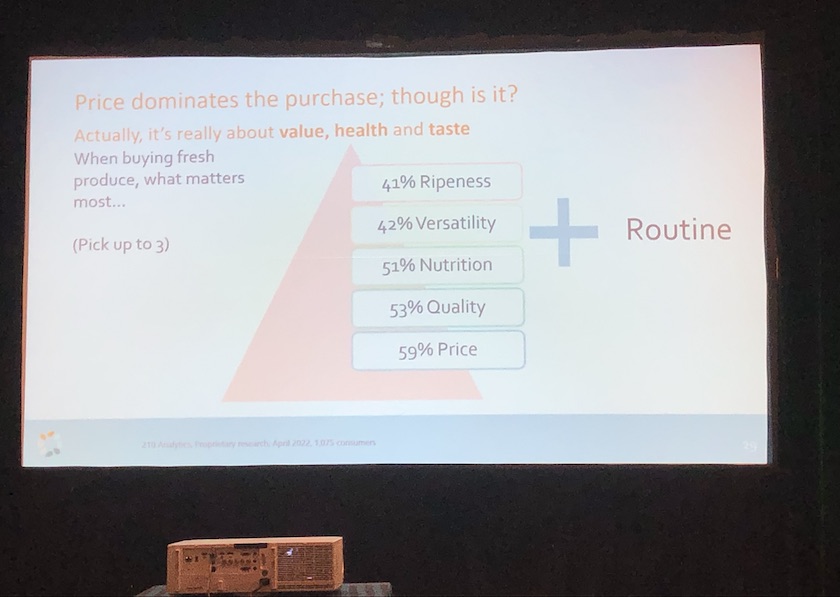

When shoppers are trying to buy less or save money other ways, price dominates their purchase decisions, but not as much as the industry would think, according to 210 Analytics data from April. Shoppers said, when buying fresh produce, this is what mattered most: 59% price, 53% quality, 51% nutrition and 42% versatility.

With price being less flexible, retailers can focus more on quality to drive sales.

“You see some retailers really highlighting that idea of quality, simply calling out in-store that ‘we work with the best producers. We really stand behind that,’” Roerink said. “Make sure that message is out there, in your stores and for your brands, as well.”