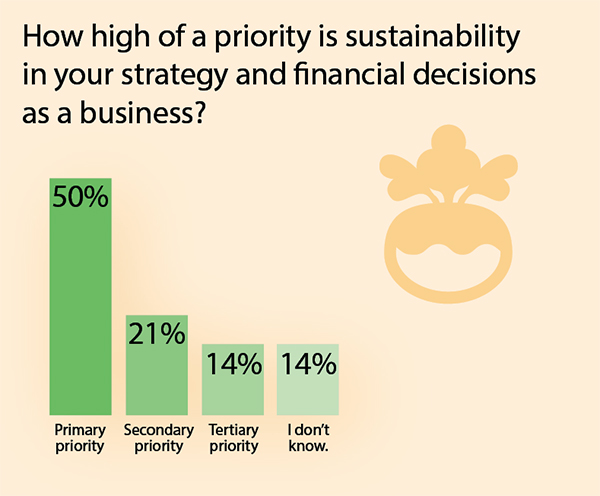

Sustainability is a top priority for most retailers

For most retailers, sustainability is a primary priority for their businesses. According to The Packer’s 2022 Sustainability Insights Survey*, 50% of retailers reported that sustainability was a primary priority and 21% said it was a secondary priority.

For most retailers, sustainability is a primary priority for their businesses. According to The Packer’s 2022 Sustainability Insights Survey*, 50% of retailers reported that sustainability was a primary priority and 21% said it was a secondary priority.

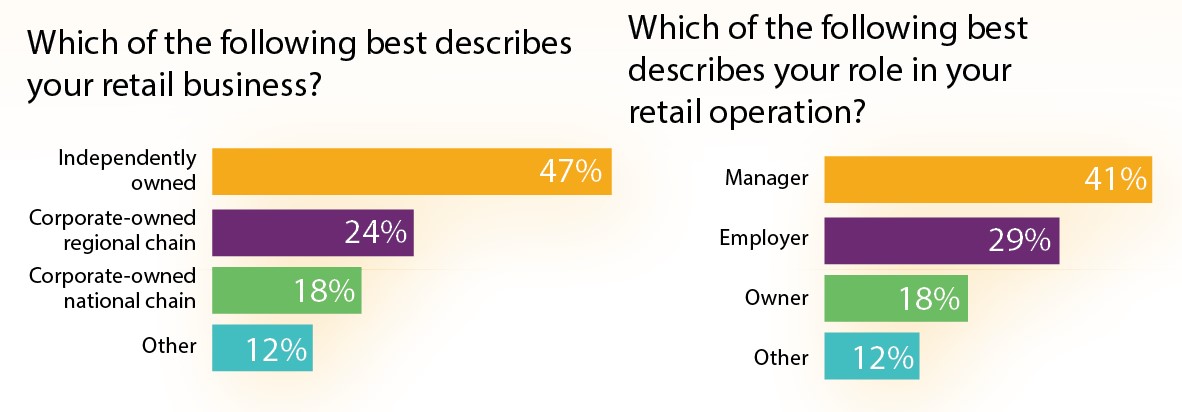

The majority, or 47%, of the retail survey respondents — hailing from across the country — are independent grocers, while 24% work for corporate-owned stores and 18% for corporate-owned national chains. Forty-one percent of respondents are managers, 29% are retail employees and 18% are owners.

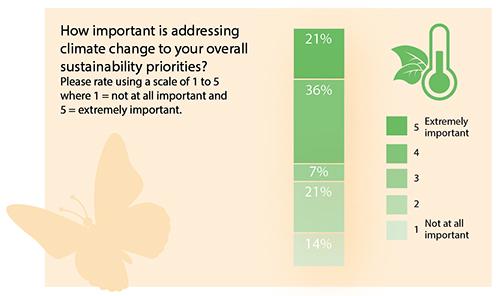

Increasingly in the headlines, climate change is also top of mind for most retailer respondents, the majority of which indicated that they consider addressing climate change to be “important” or “extremely important” to their overall sustainability priorities.

When asked to rate the importance of addressing climate change to their overall sustainability priorities using a scale of 1 to 5, where 1 equals “not at all important” and 5 equals “extremely important,” 57% of respondents rated the issue a 4 or 5. Just 14% indicated climate change is “not at all important.”

The cost of climate change

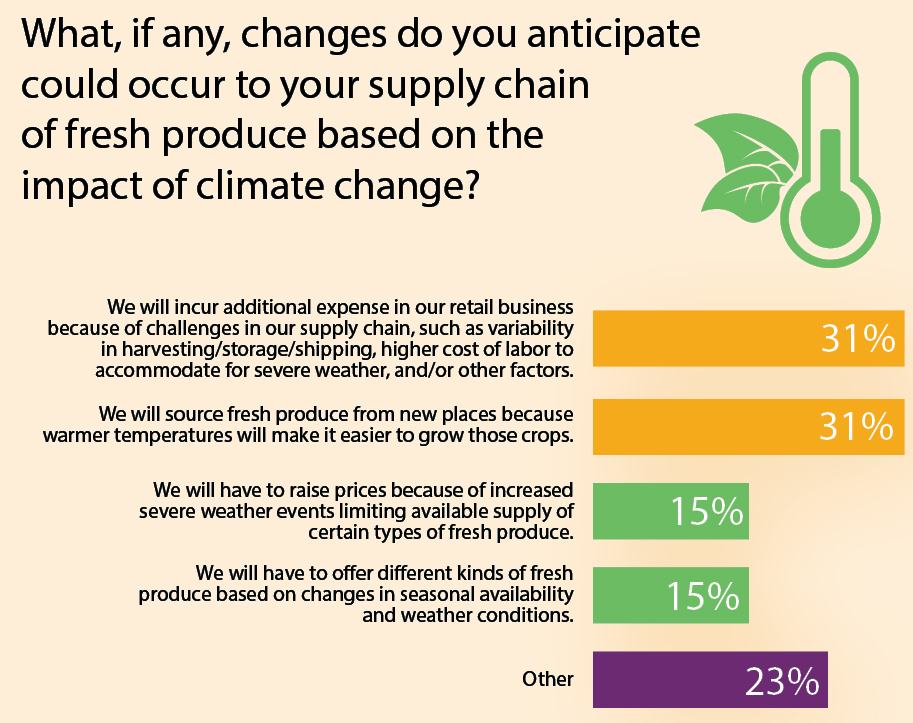

From severe weather to temperature extremes and more, climate change presents myriad challenges to the fresh produce supply chain. Some retailers anticipate these changes will impact the bottom line.

When asked what, if any, changes they anticipated to the fresh produce supply chain as a result of climate change, nearly one-third of respondents reported they expect to incur additional expenses and will need to source fresh produce from new places due to climate change.

Read more about The Packer's 2022 Sustainability Insights Survey.

Climate change may also further fuel rising food prices. Fifteen percent of survey respondents indicated they will have to raise prices because of increased severe weather events limiting available supply of certain types of fresh produce. And 15% of retailer respondents said they expect to offer different kinds of fresh produce based on changes in seasonal availability and weather conditions.

For those retailers who engage in sustainable practices, climate change is a key motivator. When asked to choose the top three reasons they have implemented sustainable practices from a list, half of retailer respondents cited addressing climate change. Other top reasons included customer demand (it is a priority for my customers) and a reduction in food waste.

Which sustainability practices have retailers embraced?

The Sustainability Insights Survey found that more retailer respondents have implemented practices to reduce greenhouse gas emissions than any other sustainability tactic, with 38% indicating they have set reduction goals.

All retailers surveyed who reported setting goals for reducing greenhouse gas emissions said they have set public goals. When asked when these goals would be announced, 40% of respondents said within one year. An equal number said the goals would be announced in three years.

Measuring carbon footprint was the next most common sustainability initiative embraced by approximately one-third of retailers surveyed. Thirty-one percent of respondents also said their businesses purchase carbon offsets. Among those who do not currently purchase offsets, 38% indicated they intend to in the future.

Both sustainable produce packaging and conversion to electric or alternative-fuel equipment are used by 23% of respondents.

Somewhat surprisingly nearly one-third, or 31% of retailer respondents, indicated that they have not currently implemented any of the sustainability initiatives listed in the survey question.

Read more about The Packer's 2022 Sustainability Insights Survey.

Who drives demand for sustainability?

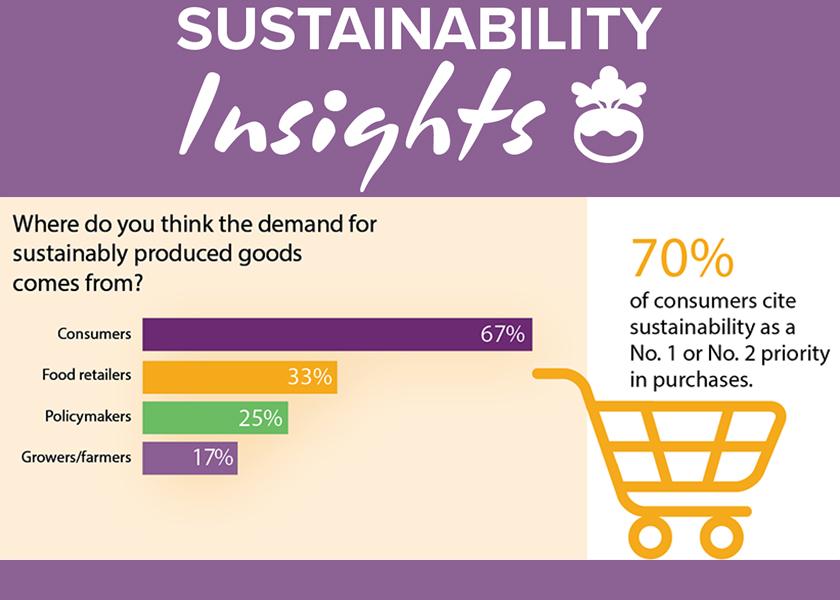

Retailers and growers agree that consumers are driving demand for sustainably produced goods. The 2022 Sustainability Insights Survey finds that the majority of retailers, or 70%, and a slightly higher percentage of growers (71%), think consumers fuel demand for sustainable products.

Their assertions appear to be founded. The survey also revealed that 70% of consumers cite sustainability as their No. 1 or No. 2 priority, when making a purchase.

Interestingly, retailers see consumers, themselves and policymakers driving sustainability trends, but growers and farmers less so. Thirty-three percent of retailers who responded to the survey indicated that food retailers drive demand for these goods, 25% said policy makers, and just 17% said growers and farmers are leading demand.

A different perspective emerges, however, when retailers were asked who they felt is “most responsible for leading and promoting sustainability practices and policies?”

Forty percent of retail respondents cited growers as being most responsible for leading and promoting sustainability practices and policies. Rounding out the picture, 20% of survey respondents said retailers were responsible, and 10% pointed to the federal government.

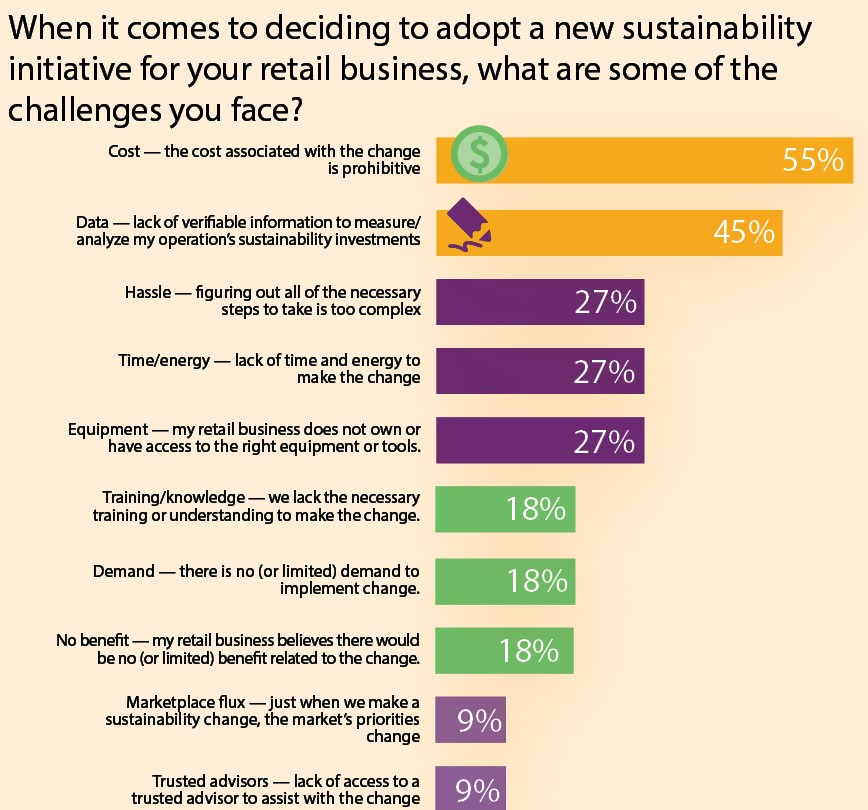

Cost ranks as No. 1 challenge to sustainability at retail

The survey asked retailers, “When it comes to deciding to adopt a new sustainability initiative for your retail business, what are some of the challenges you face?”

Cost was the No. 1 response, with 55% indicating that the cost associated with the change is prohibitive. Lack of data or verifiable information to measure and analyze investments in sustainability also ranked as a key challenge among 45% of respondents. The effort involved in mapping out a sustainability plan and a lack of time and the necessary tools to pursue it were also cited as challenges.

What’s more, most retailers do not feel they are fairly compensated for the extra costs incurred by implementing sustainability initiatives, with only 9% of retailers responding “yes” to the question of fair compensation.

Read more about The Packer's 2022 Sustainability Insights Survey.

How retailers are working to reduce food waste

One-third of all food is reportedly wasted. It’s a staggering statistic and one that a growing number of retailers are doing their part to combat.

In the survey, almost all retailer respondents (89%) reported donating food that would otherwise be wasted and half report partnering with vendors who repurpose food.

Retailer respondents further indicated that they help growers in their supply chain to improve on-farm storage as well as create value-added products to make fuller use of all produce grown.

When asked about setting food waste reduction goals or targets for their retail business, approximately half of retailer respondents reported setting such goals.

Sustainable packaging perceptions

When it comes to activities that move the needle on sustainability in retail businesses, compostable packaging was most often rated, among the measured items, as having a “very positive impact” on sustainability, according to the survey.

Somewhat fewer retailer respondents also perceive biodegradable packaging that breaks down naturally as having a “very positive impact.”

Most retailers further cited compostable and biodegradable as indicators of sustainable packaging, while 50% of respondents pointed to both recyclable and packaging that protects the product to reduce food waste as sustainable.

How should the cost of sustainable packaging be shared across the supply chain? Retailers felt the cost of sustainable packaging should be shared across all or most participants along the food chain, with 56% indicating so. And when asked, “How much more do you think consumers are willing to pay for more sustainable packaging?” Most retailers felt consumers would pay no more than 5% to 10% more for it.

Based on results from the Sustainability Insights Consumer Survey, retailers are right on the money.

The survey asked consumers, “How much more are you willing to pay for bio-based packaging?” Or in other words, packaging that degrades naturally, without needing to be recycled or thrown away. Forty percent of consumers surveyed reported being willing to pay 5 to 10% more.