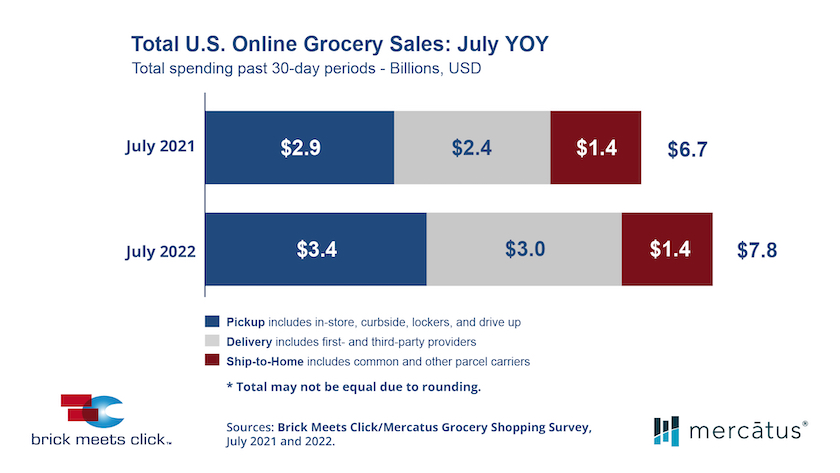

July e-grocery sales climb 17% from a year ago

Online grocery sales aren’t dropping anytime soon.

Total U.S. online grocery sales for July jumped 17% year over year to $7.8 billion, driven by inflationary pressures and strong demand for delivery and pickup services triggered by ongoing COVID-19 pandemic concerns, according to the Brick Meets Click/Mercatus Grocery Shopping Survey conducted July 29 and 30.

During July, more than 68 million households went online to buy groceries, a 3% gain versus last year, but only the pickup and delivery segments benefited from that increased demand, the news release said. Pickup’s monthly active user (MAU) base expanded more than 5%, and delivery’s expanded nearly 4% during the month, while ship-to-home’s MAU base contracted more than 4%.

“COVID-19 concerns coupled with inflation have forced a tradeoff between two fundamental desires for shoppers – not getting infected and not paying more than necessary,” Brick Meets Click Partner David Bishop said in the release. “While online shopping — especially delivery — costs more than in-store shopping, using an online service may help prevent illness which could cost more in the longterm due to lost wages and other life complications.”

Define it

Brick Meets Click is a grocery analytics and data insights firm, and Mercatus is a digital grocery commerce platform provider. The survey used the answers from 1,690 adults, 18 years and older, who participated in the household’s grocery shopping.

These are the three receiving methods for online grocery orders:

- Delivery includes orders received from a first- or third-party provider such as Instacart, Shipt or the retailer’s own employees.

- Pickup includes orders that are received by customers either inside or outside a store or at a designated location or locker.

- Ship-to-Home includes orders that are received via common or contract carriers such as FedEx, UPS (United Parcel Service) and U.S. Postal Service.

The COVID-19 effect

The research found that only one-fifth of households were “not at all concerned” about catching COVID-19, and 36% of those households indicated using a grocery pickup and/or delivery service during the past month. As concern increased, so did pickup and/or delivery rates:

- For shoppers “slightly” concerned about catching the coronavirus, pickup and/or delivery rates rose by 6%;

- For those who said “somewhat,” it rose 15%;

- “Very,” by 20%; and

- “Extremely,” by 53%.

During July, 41% of all U.S. households used a grocery pickup and/or delivery service, suggesting that around 5 percentage points, or over 10% of MAUs were influenced by COVID-19 pandemic concerns to some degree if compared against usage rates for those with no concern.

Then add inflation

The crosswinds caused by inflation and the COVID-19 pandemic also likely help to explain shifts in where households are shopping online for groceries. Compared to July of 2021, mass retailers, which appeal to more cost-conscious shoppers, experienced an increase of just over 1% in the number of MAUs while grocery retailers’ MAU base contracted over 10%.

Inflation’s impact was visible in spending as the average order value aggregated across all three receiving methods grew 11% on a year-over-year basis, according to the report. Delivery reported the largest average-order-value increase, growing 13% versus the prior year, followed by ship-to-home, which rose 9%, and pickup reported a more modest gain of 5%. From a channel perspective, average order values for pickup and delivery orders climbed 9% in grocery and 10% in mass retailers versus July 2021.

Monthly order frequency edged up 3% as MAUs received 2.8 online grocery orders in July 2022, the highest average order frequency since December 2021. The gain, however, was not evenly distributed across the receiving segments or key channels like grocery and mass retail.

Pickup gained more than 2 points of order share in July versus last year, rising to 39% of all orders as order frequency among its MAUs increased by 10%. Delivery gained around 1.5 points of order share, finishing with 31% of all orders as order frequency for its MAU base rose 8%. Ship-to-home’s order share dropped 4 percentage points to under 30% as MAUs received 9% fewer orders during the month. Looking at key channels showed that mass-retail customers increased the number of monthly orders by 5% while grocery customers decreased their order frequency by 2%.

Repeat customers

The likelihood that an online grocery shopper will use the same service again within the next month remained very stable, strengthening by nearly one point versus last month and finishing at 64% for July. That month-over-month gain was attributed to stronger repeat intent scores from mass retailers (68%) as the gap versus grocery (at 58%) widened, landing at 10+ percentage points for the month.

“Online customers are highly motivated by convenience, and pickup offers customers a higher degree of convenience and control at a lower cost than delivery,” Mercatus President and CEO Sylvain Perrier said in the release. “My advice to regional grocers is to use your store locations to your competitive advantage and promote pickup services to your delivery customers.”

The widening gap in repeat intent is especially concerning because cross-shopping between grocery and mass retailers increased to 30% in July, 4 points higher than last year. This means that three in 10 customers who placed at least one online order with grocery during the past 30 days also placed an order with a mass retailer. These results should motivate grocery retailers to reassess elements of their value proposition as well as how well they are executing their respective strategies.