The Packer's 2023 Organic Fresh Trends revealed

The Packer’s Organic Fresh Trends 2023 survey polled more than 1,000 consumers in mid-October, discovering differences in how consumers report purchases of fresh fruits and vegetables.

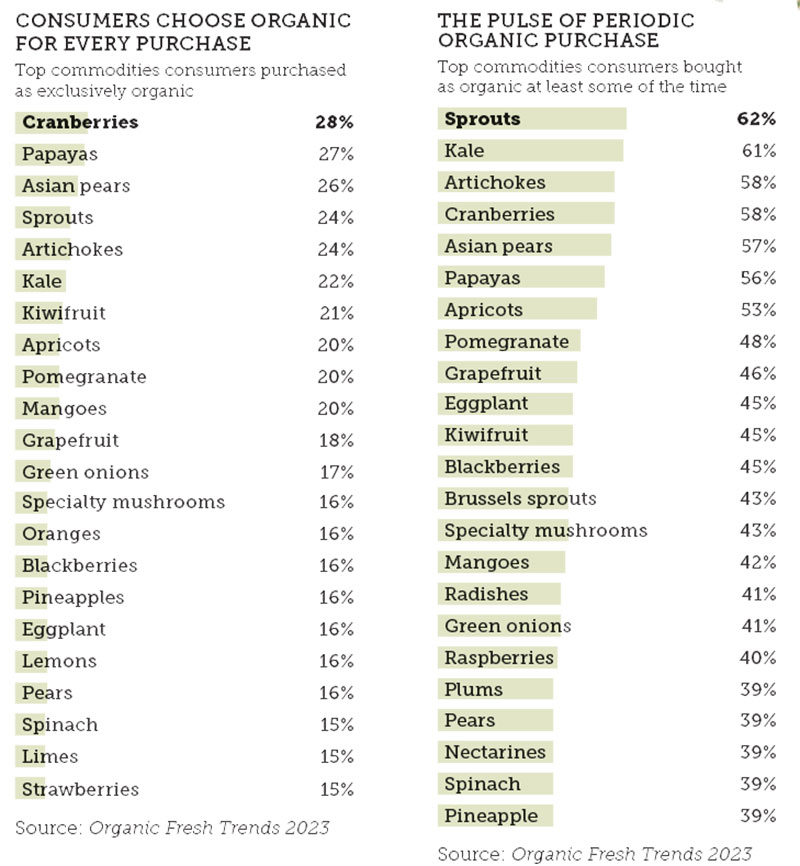

In terms of commodities most often purchased exclusively organic, consumers reported a wide range of responses, from just 8% for cantaloupe and sweet corn to 28% for cranberries, 27% for papayas, 26% for Asian pears, 24% for sprouts and artichokes and 22% for kale.

For those consumers who purchased organic produce at least periodically, Organic Fresh Trends 2023 identified top commodities as sprouts (62%), kale (61%), artichokes (58%), cranberries (58%), Asian pears (57%), papayas (56%) and apricots (53%).

Organic commodities ranked near the bottom of those that were purchased at least periodically by consumers include sweet corn (29%), watermelon (28%), cantaloupe (27%), potatoes (27%) and onions (27%).

The roughly 6 out of 10 polled who indicated that they at least periodically purchased organic produce were asked this question: “What percentage of your total annual fresh fruit and vegetable purchases are organic (your best estimate)?”

In their responses, 1 in 10 organic consumers (10%) said organics represented more than 75% of their annual fruit and vegetable purchases, compared with 7% who indicated that level of organic purchasing a year ago.

Nineteen percent, or roughly 1 in 5 shoppers surveyed, said that organic produce represents between 51% to 75% of their annual fruit and vegetable purchases. That compares with 18% a year ago who said organic produce commanded that percentage in their grocery purchases.

Join us for GOPEX 2023! As the only globally driven show for organic produce, this show creates a forum for unique and specific opportunities. Network, exchange ideas, source new products and services, and do business with the industry’s leading growers, distributors, packer and retailers. Register today!

One in 4 organic consumers (26%) said that organic produce represented between 11% to 25% of their annual fruit and vegetable purchases, compared with 25% of consumers who indicated that organic purchase share a year ago.

Finally, 13% of organic consumers said their annual organic produce purchases account for between 1% to 10% of their annual fruit and vegetable purchases, compared with 15% of consumers who indicated that answer in Organic Fresh Trends 2022.

Consumers who indicated at least some purchases of organic produce in the past year were also asked this question by Organic Fresh Trends 2023: “How much more are you willing to pay for organic fresh fruits and vegetables over what you’d pay for conventionally grown produce?”

In response to that question, the survey found 11% were not willing to pay any premium, compared with 10% in the 2022 survey.

Twenty-seven percent were willing to pay a premium of up to 10%, compared with 26% of consumers with that answer in the 2022 survey.

Thirty-one percent said they would pay a premium of between 10% and 24% more than conventionally grown produce, compared with 32% of consumers who responded that way in Organic Fresh Trends 2022.

Nineteen percent said they would pay a premium for organic between 25% to 49% more than conventionally grown produce, compared with 20% of consumers who responded with that answer a year ago.

Nine percent said they would pay a premium of 50%, compared with 8% of consumers who gave that answer a year ago.

Three percent said they would pay a premium of more than 50% compared with conventionally grown produce, compared with 4% who gave that answer a year ago.

Organic Fresh Trends 2023 also asked consumers who reported purchasing organic produce at least periodically about how they prefer to see organic produce displayed at retail stores where they shopped.

Most surveyed (70%) indicated they want to see organics in their own separate area, while 30% want to see organic produce intermixed with other conventional produce, such as putting organic apples next to conventional apples, marked with signs.

Those answers were virtually unchanged from Organic Fresh Trends 2022.

Organic Fresh Trends 2023 asked consumers what factors contributed to their decisions to buy organic.

In response to this question, “What thoughts go into whether to buy organic fresh fruits and vegetables or not?” consumers said:

- Price – is it worth the extra cost? I weigh the price vs. the advantage to my health: 71%, compared with 70% for Organic Fresh Trends 2022.

- Packaging – organic product is more convenient: 26%, compared with 24% in 2022.

- Appearance – organic is fresher/cleaner/riper than conventionally grown product: 45%, compared with 40% in 2022.

- Signs tell me where/how the product was grown, and that influences my decision: 18%, compared with 20% in 2022.

- Signs that list advantages of organic (chemical-free, pesticide-free, etc.), and that influences my decision: 17%, unchanged from a year ago.

Inflation effect

The survey also asked consumers about how high grocery inflation changed their purchase pattern for all produce.

While the question wasn’t particular to organic produce, it did show how shoppers have adjusted: “How have inflated food prices over the past year affected your purchasing patterns (particularly with fresh produce)?” Their responses:

- I buy less: 36%

- I cut back on other areas of my budget to be able to buy the same amount/types of food: 44%

- I've changed the type of food I buy (buy less expensive items): 28%

- I'm growing more of my own fruits and vegetables: 10%