More than 50% of U.S. households ordered groceries online in December

E-commerce in the grocery sector certainly hasn’t tanked now that shoppers have re-emerged into the world the last year or so, after hibernating those first two years of the COVID-19 pandemic.

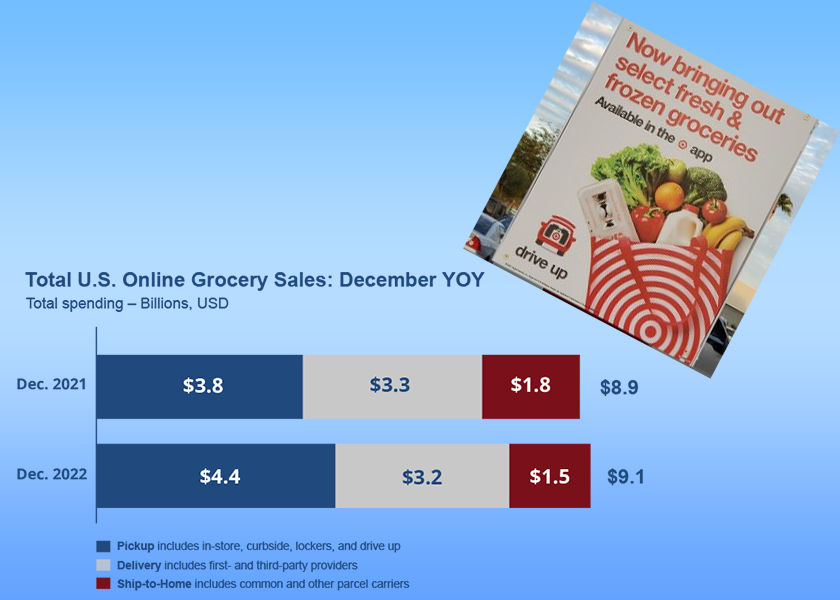

The U.S. online grocery market finished December with $9.1 billion in total sales, up 2.4% compared to a year ago, and only 2% lower than the record high of $9.3 billion last seen in the first quarter of 2021, according to the monthly Brick Meets Click/Mercatus Grocery Shopping Survey fielded Dec. 28-29, detailed in a news release.

December’s strong monthly sales results and year-over-year gain were driven by positive trends for the online-order receiving method of pickup and mass retailers, such as Walmart and Target. Credit for these gains could also go to more households buying groceries online during the month and slightly higher average order values — although these still trailed grocery price inflation.

“The investments that mass retailers have put into their pickup services are a significant driver of the format’s gains,” Brick Meets Click partner David Bishop said in the release. “And while lower prices are a contributing factor in the growth of the mass [monthly-active-user] base, being able to more consistently execute at the store level is also helping to strengthen retention and engagement with existing customers, especially when compared to grocery [stores].”

December 2022 year-over-year

Sales trends showed mixed results for receiving methods and formats. Pickup was the only method to gain sales during December, up 14.7%. Delivery declined slightly, down 1.8%, and ship-to-home dropped more dramatically, down 16.2%.

As with November trends, orders placed with mass retailers contributed more significantly to the growth of total online grocery sales than orders placed with grocery retailers, driven by changes in the two formats’ monthly active users, average order value and order frequency.

Base of monthly active users up

More than half of all U.S. households ordered groceries online during December, up 4% versus year ago, according to the release.

The pickup receiving method benefited the most from this increase in demand, as almost 5% more monthly active users chose pickup in December. Delivery was slightly positive, and ship-to-home experienced a drop of more than 8% in monthly active users.

By format, while the grocery store’s monthly active user base climbed nearly 7% versus the prior year, the mass retailer’s monthly active user base expanded nearly three times faster and attracted almost half of the total monthly active user base in December.

Cross-shopping between grocery and mass retailers climbs

During December, more than 30% of monthly active users bought groceries online from both grocery and mass retailers, about 130 basis points higher than a year ago.

The level of cross-shopping between grocery and mass remained elevated for the second month in a row, likely driven by persistent inflation and/or a more acceptable experience driving mass retailers’ customer expansion.

Average order value

The average order value was up overall year-over-year, but there were mixed trends by method and format.

For December, spending per order across the three receiving methods grew about 6% versus last year on an aggregate basis, which is below grocery-related price inflation.

- By method: Pickup’s average order value for the month was slightly above the aggregate average while delivery matched the aggregate and ship-to-home posted a mid-single-digit decline.

- By format: Grocery reported a gain in average order value of 4% versus last year while mass average order value grew three times faster with a year-over-year increase of 12% for December.

Order frequency

Order frequency was down overall year-over-year, but there were mixed trends by method and format.

Overall order frequency, defined as the number of orders received by an monthly active user on average during the period, slid 7% versus December 2021 at the aggregate level.

By service method:

- Ship-to-home’s order frequency dropped twice as much as the aggregate.

- Delivery’s drop wasn’t as severe but still a double-digit decline.

- Pickup saw order frequency grow slightly among its monthly active users.

By format, order frequency continued to show divergent year-over-year trends as it decreased by 7% for monthly active users of grocery retailers, while it increased 3% for monthly active users of mass retailers.

eGrocery share of spending down

Total grocery spending during the last week of December climbed nearly 15% versus the same period last year, according to the release.

As a result, the online share of total grocery spending fell slightly versus the prior year, finishing at 13.2%.

Excluding the ship-to-home receiving method because most conventional supermarkets don’t offer it, the adjusted contribution from pickup and delivery was 11% for the month.

Repeat customers

The composite repeat rate (the likelihood that customers will use the same service again within the next month) dropped 670 basis points to 56% for the month versus year ago. The majority of that year-over-year decline was driven by first-time users.

While repeat intent rates were down for both mass and grocery retailers in December, mass continues to outperform grocery on this metric.

“Regional grocers have many opportunities to improve the customer experience and the profitability of operating an online grocery service today,” Mercatus President and CEO Sylvain Perrier said in the release. “From our ongoing work and research into online customer behavior, we’ve learned how important it is to develop a strategy that makes sense both financially and operationally, and that builds on how a grocer is positioned in the market and with their core customers.”