Has The Farm Financial Picture Turned Dire? Ag Economy Barometer Reveals Reality of Input Price Pain for 2022

U.S. Farm Report 01/29/22 - Farm Journal Report

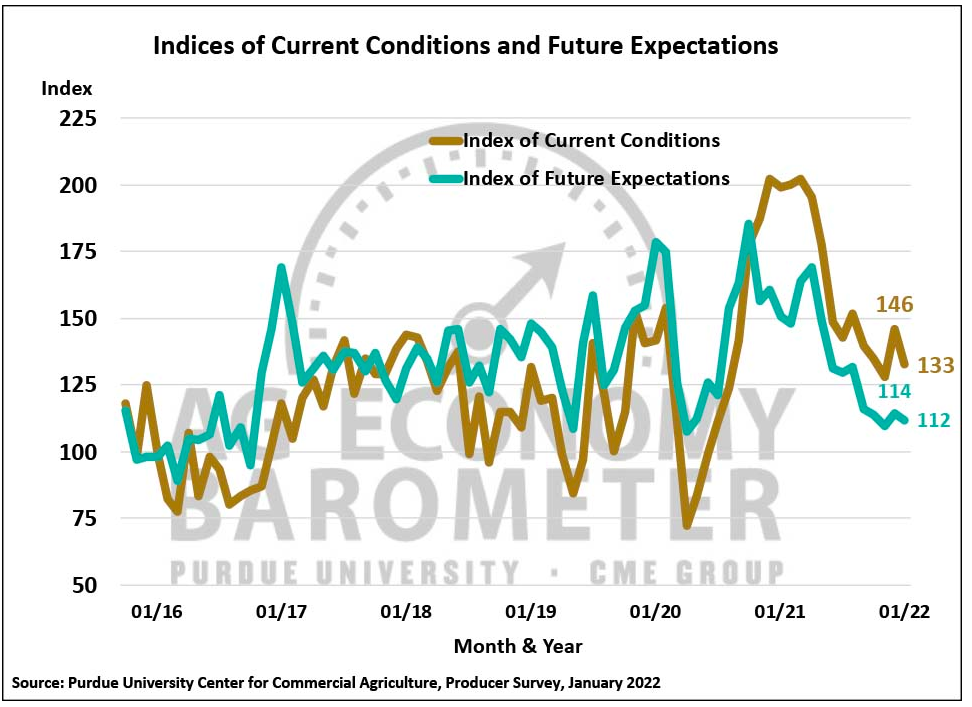

No matter where you travel across the country right now, farmers share similar sentiments and concerns. And it's those concerns weighing on outlooks as the latest Ag Economy Barometer fell to its lowest reading since July 2020 with economists showing a sharp decline in income for 2022 compared to 2021.

“The biggest thing that changed for our farm is the input cost this year. I think that's going to be a real challenge," says Randy Poll, president of the Michigan Corn Growers Association and a farmer based near Hamilton, Mich.

As input prices climb, corn and soybean commodity prices are strong and seem to be gaining strength, but it still may not be enough.

“The pricing really seems to be a little bit out of control,” adds Poll. “Corn and soybeans aren't keeping up with the input costs.”

Purdue's Jim Mintert, professor of Agriculture Economics, joins Chip Flory on AgriTalk to break down the results of the latest Ag Economic Barometer.

Pinched Profits

Matt Frostic is chairman of Michigan Corn Board. The Applegate, Mich. farmer says profits will be pinched with the current price scenario.

“We're looking at breakeven costs and trying to find a margin if we can,” says the Michigan farmer.

Both farmers say even with commodity prices higher than where corn and soybeans sat two years ago, input prices have soared at a much quicker rate.

“We had that spike in corn a year ago in the summer; now we've come back to that $5.50 range, which is a fair price. But when our inputs are so high, three times as much as a year ago, that's going to be a real concern and a challenge to pencil that out,” adds Poll.

Input Cost Reality Check

Issues with input issues are evident in the latest Purdue University/CME Ag Economy Barometer. The January barometer fell 6 points, which marks the lowest reading since July 2020. The survey of 400 producers showed supply chain disruptions aren’t just causing angst, prompting producers to adjust their outlooks for the farm financial picture for 2022.

“The sharp drop in the financial performance index this month indicates producers expect a sharp decline in income in 2022 compared to 2021. In the December survey, producers were focused on comparing a very positive income year, 2021, to 2020, which really supported the index at year end,” says Jim Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

The January Ag Economy Barometer shows:

- 57% of respondents expect farm input prices to rise by 20% or more in 2022.

- 34% of producers said they expect prices to rise by 30% or more.

And in terms of availability, survey responses showed:

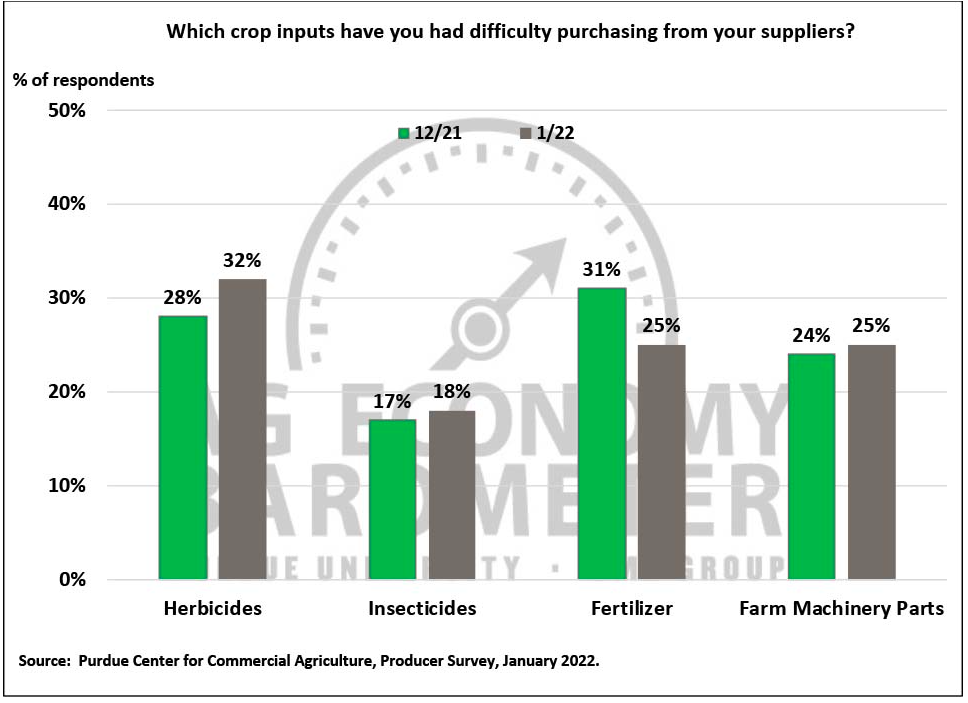

- 28% of producers said they have had difficulty purchasing crop inputs from suppliers for the 2022 crop season.

- In a follow-up question posed to producers experiencing difficulty in procuring crop inputs, respondents reported difficulty in purchasing a broad spectrum of crop inputs including herbicides, insecticides, fertilizer and farm machinery parts.

- The rise in farm input costs was also the primary reason why many producers are expecting to have a larger operating loan in 2022.

- 27% of respondents said they expect to have a larger operating loan in 2022 than a year earlier, 10 points higher than on last year’s survey and 12 points higher than two years ago.

Supply Chain Concerns

“Rising farm input costs and ongoing supply chain disruptions appear to be contributing to producers’ weaker perception of current conditions and expectations of their farm’s financial performance in 2022 when compared to last year,” says Mintert.

The Ag Economy Barometer shows prices for nitrogen fertilizer have skyrocketed over the last year. The Barometer cites USDA data and shows:

- Anhydrous ammonia (NH3) prices in Illinois during January 2022 were nearly triple what they were in January 2021.

- Although a majority (57%) of corn producers said they intend to use the same nitrogen application rate in 2022 as in 2021, nearly four out of 10 (37%) said they intend to reduce their nitrogen application rate compared with last year.

As input prices place strain on producers, farmers are looking to reduce application rates.

“Talk to some of my neighbors; they're thinking they're going to have to just cut back on inputs. And I think what's going to happen is our yields will suffer. So I think as a whole, as a country, we may have a lower yield,” says Poll.

And it’s not just price shaping outlooks and weighing on planting decisions this year. Supply is also a major concern, especially for chemistry.

“Another concern I have is getting some of the chemistry for herbicides. I've been hearing rumors that atrazine is going to be tight, and we use that in our rotation for herbicides,” says Poll.

Those on the Front Lines

For producers on the front lines, the input situation adds another layer of uncertainty to the gamble of farming everywhere.

“It's certainly taking more of our time and resources to figure out the avenue to what we are going to plant. Are we going to plant more corn or more soybeans?” Frostic says.

Delayed Acreage Decisions

And some farmers say depending on how the input situation plays out, the ultimate decision on acreage may not happen until May.

“That could be depending on when we get it, and we probably won't know that until middle of April or even May,” says Poll.

Overall, the Ag Economy Barometer “Index of Current Conditions” fell 13 points to a reading of 133. The Index of Future Expectations changed little in January, down 2 percentage points to a reading of 112.

The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from Jan. 17 to Jan. 21.