Chilean grape exporters look for big increase in production and exports

Chilean table grape production will jump by nearly 15% in the 2023-24 marketing year, a new report from the USDA Foreign Agricultural Service says.

The annual report on Chile’s deciduous crops estimates abundant rainfall and good yields will allow Chilean table grape production in marketing year 2023-24 to increase 13.6% to 740,000 metric tons.

In the same way, Chilean grape export volume is expected to rise by 13.5% to 564,000 metric tons, the report said.

Chilean apple production in marketing year 2023-24 is forecast to decrease by 1.5% to 897,000 metric tons due to a reduction in area planted, according to the report. Apple exports also are projected to decrease by 1.9% to 510,000 metric tons, the USDA projects.

Chilean pear production in marketing year 2023-24 is estimated to fall by 4.8% to 200,000 metric tons due to a decrease in area planted, the report said, and pear exports are forecast to decrease by 4.5% to 105,000 metric tons.

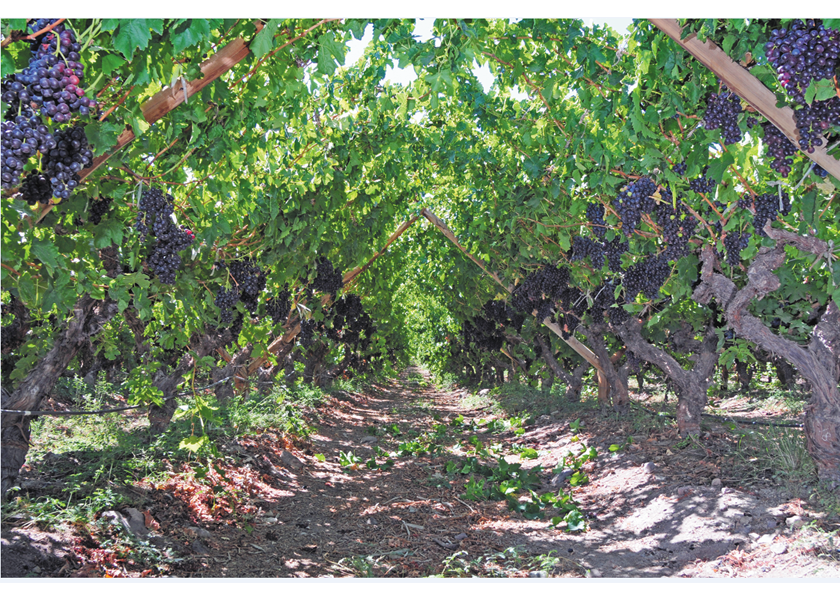

Grape surge

The positive outlook for grapes is the result of abundant rainfall during the winter and overall favorable climatic conditions, according to the report.

Despite better yields this year, the report said table grape area planted is trending downward over time because of long-term tight margins for producers.

“Area planted decreased from 133,068 acres in marketing year 2011-12 to 106,317 acres in marketing year 2022-23,” the report said. “Increasing international competition and low prices for traditional varieties such as crimson, flame, and red globe has put pressure on smaller table grape exporters, many of which eventually exited the market.”

The USDA said Chilean table grape area planted in the Metropolitana region (the regions that include Chile's capital, Santiago, along with parts of the Andes Mountains and Chilean Coastal Range) decreased by 14.1% over the last three marketing years, generally replanted with more profitable crops such as walnuts, cherries and citrus.

The report said the Atacama and Coquimbo regions remain the most threatened of Chile’s grape producing areas, with declining acreage related to high production costs and low global grape prices.

“In recent years, the costs of labor, transportation, and agrochemicals have increased dramatically, while producers struggle to compete with the prices offered by Peruvian and other regional suppliers,” the report said.

On the trade front, the USDA noted that Chile seeks a systems approach to improve market access to the U.S. for three Chilean growing regions: Atacama, Coquimbo and Valparaiso.

“A systems approach would benefit the three Chilean regions by avoiding the use of methyl bromide fumigation to mitigate against European grapevine moth,” the report said. Fumigation decreases the quality and shelf life of the fruit, which results in lower prices from retailers. In addition, fumigated product is ineligible to be certified USDA organic.

“Notably, two of the three regions that will benefit most from the systems approach are those that have few options to table grape production and are also now seeing large decreases in area planted,” the report said. USDA published a proposed rule to allow the grape systems approach on Oct. 17, 2022. The comment period ended on Jan. 17, 2023, and publication of the final rule is currently pending.

The U.S. is the main market for Chilean table grape exports, accounting for about 50% of Chile’s grape exports in 2022-23.

However, the report said Chilean table grape exporters are facing challenges in the U.S. market due to the demand for new table grape varieties and increasing competition with Peruvian table grape exports.

China is the second biggest export market, taking about 12% of Chile’s grape exports in 2022-23.

“The shipping distance from Chile to China remains the biggest challenge for Chilean table grape exports to that market,” the report said, noting transit times of three to four weeks.