Consumer shopping behavior detailed in special report

An "Omnichannel Special Report" from data insights firm 84.51° examined who omnichannel shoppers are, where they shop and some of the reasons why they choose to shop in-store and online.

84.51° helps The Kroger Co. and its partners create customer-centric shopper journeys, unpacks the continuing effect of omnichannel on consumer behavior, based on real-time insights surveys.

The base used for the study included only those who shopped both in-store and online at Kroger — also called hybrid shoppers — over a 52-week period.

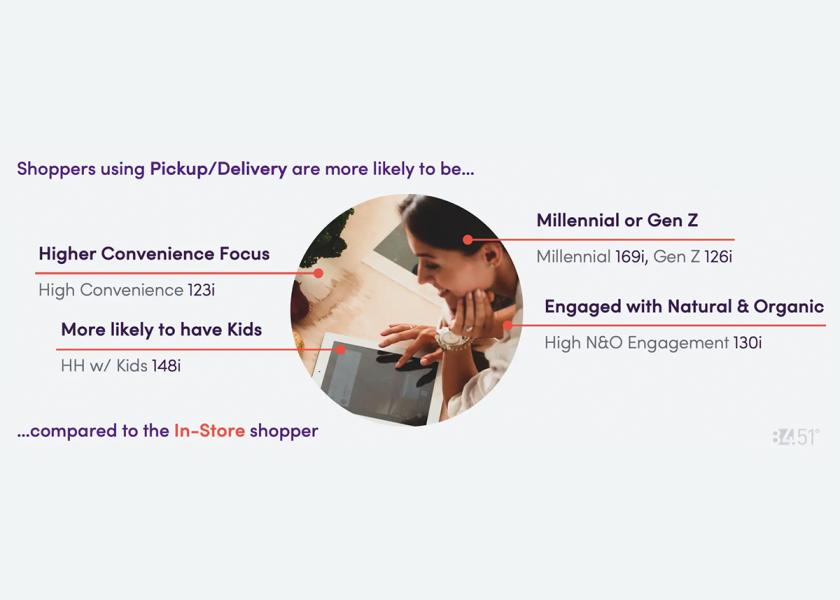

According to the report, this shopper is likely to be a millennial or of Generation Z, engaged with natural and organic, more likely to have children and is focused on convenience, compared to the average grocery shopper. With only 40% of omnichannel shoppers saying they shop mostly online, these shoppers still make 83% of their trips in-store versus pickup or delivery, the report said.

Forty-six percent of omnichannel shoppers said that they spend less time ordering online compared to in-store. Over 80% of these shoppers who use pickup and delivery cited convenience as the reason for doing so.

Claims of less stress have significantly increased from 2023, according to the report. This year, 58% of shoppers said in the report it’s less stressful to shop online than in-store, compared to 39% in 2023. And 57% of shoppers said online shopping has become their preferred method of shopping, compared to 28% in 2023.

When shopping in-store, claims of preferring to pick items, avoiding extra fees and not wanting the wrong item have increased since 2023, the report said. Fifty-six percent preferred to pick out their groceries and 51% wanted to avoid pickup or delivery fees.

Omni-shoppers continued to prefer buying fresh categories in-store. Like the 2023 study, 75% of omnichannel shoppers claimed that they preferred to purchase fresh produce, bakery and deli/meat/seafood in-store. Paper products, shelf-stable goods and household cleaning are the most preferred for purchasing online.

Over 80% of omnichannel shoppers claimed that order accuracy and availability are important when shopping online, and 23% will shift their spending elsewhere if items are out of stock, the report said.

Accuracy and availability are so important that brands may be missing out if items are out of stock, according to the report. Nineteen percent of shoppers said they will buy the out-of-stock item online elsewhere, and 4% will switch their entire cart to a different online retailer that has the item in stock.

Omni-shoppers rely on a retailer's website or app for inspiration, according to the report. Almost 50% of omnichannel shoppers, and even more for younger shoppers, are using social media as inspiration for their shopping lists. They are still more likely to try new items in-store but will use search or a dedicated section of a site to find those new items.

The full report can be viewed here.