The Next Generation of Bioplastics

Corn might give the plastics industry a makeover

Bioplastics and biochemicals made from the sugar and sometimes protein of corn, soybeans and other crops will likely never replace ethanol as one of corn’s key markets. However, they will be a growing market for corn and other field crops if manufacturers can produce them cheap enough to compete with petroleum-based plastics.

"Ethanol has had a massive impact on the corn market but only a minor impact on the fuel market," says Olly Peoples, co-founder and chief science officer for Metabolix, a bioscience company that produces biochemicals and resins to make bioplastics from crops. By contrast, bioplastics and biochemicals have the potential to make a major impact on the plastic and chemical industries.

The ethanol industry produces 14 billion gallons of biofuel, which is equivalent to about 190 million tons of corn sugar, Peoples says. From that, bioscience companies such as Metabolix could produce 90 million tons of biochemicals, which is a year’s worth of U.S. demand for the equivalent convention of chemicals.

|

"Compostable plastics make sense only if you have a compostable infrastructure." — Frederic Scheer, founder and CEO of Cereplast |

The bioplastics industry is even larger. Bioplastics can be made from PHA (Polyhydroxyalkanoates) and PLA (polylactide) resins. PLA plastics are hard and rigid and won’t degrade unless they are sent to a municipal compost facility where temperature and composting time are controlled. PHA plastics are flexible, marine degradable and compostable.

Recent research could expand the market for these and other bio-based products. "We’ve been testing a plastic that is half PLA and half soy protein," says David Grewell, an Iowa State University researcher. "If put it in the ground, it acts like a fertilizer."

Garden pots are one application for this plastic; the pots can be used to grow the plants. When the plants are ready to be put into the ground, they are removed from the pots, and the pots are placed into the garden near the plants’ roots.

Double Duty. "A few months later, the pot has biodegraded and the plant is fertilized," Grewell says.

The self-fertilization feature of these pots is due to the fact that they are made partially using soy proteins. Corn proteins can also be used to produce these bio-pots, which are not yet commercially available.

"We’ve been studying these pots for several years," Grewell says. "From vegetables to flowers, plants grown in these pots are larger, healthier and nicer looking than plants grown conventionally."

Metabolix technology is also used in a biodegradable soil wrap that looks like a plant pot. "You just stick it in the ground along with the plant," Peoples says. Within a couple of months, these pots have fully degraded. Unlike Grewell’s pots, Metabolix pots are made from corn sugars and are not self-fertilizing, but they are commercially available.

Currently, the ethanol industry produces

|

Compared to that of petroleum-based plastics, the bioplastics manufacturing process produces fewer greenhouse-gas emissions. Also, bioplastics don’t contain bisphenol A (BPA), which supposedly can disrupt hormones in humans.

However, PHA bioplastics need to be composted. PLA bioplastics can be industrially composted and sometimes recycled, but recycling and composting remain controversial.

Parts of Europe have a composting infrastructure, and like recycling, the U.S. infrastructure is not uniform. Areas with composting include parts of the West Coast, such as Seattle and San Francisco, and states such as Minnesota, Oregon, Pennsylvania and parts of New England.

"Compostable plastics make sense only if you have a compostable infrastructure in place," says Frederic Scheer, founder and CEO of Cereplast, a bioscience company headquartered in El Segundo, Calif. "EPA is pushing for it, but it will take time to build."

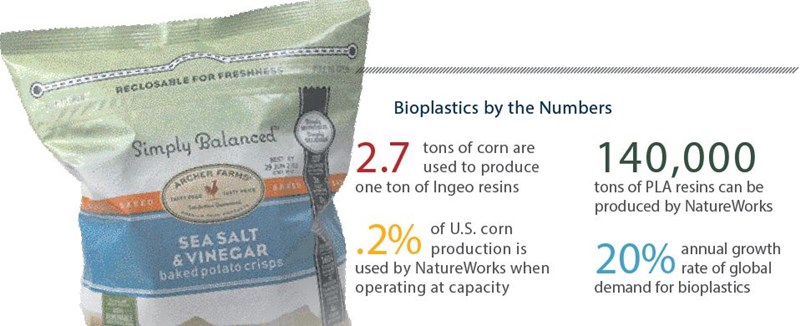

Corn Everywhere. NatureWorks LLC, which is based in Blair, Neb., and jointly owned by Cargill and Thailand’s PTT Global Chemical, produces Ingeo PLA resins used in deli food containers, food-service ware, textiles, baby wipes and a range of durable products. The company has the capacity to produce 140,000 tons of PLA resins a year, says Steve Davies, NatureWorks spokesperson.

"It takes the starch from 2.7 tons of corn to produce one ton of Ingeo resins," Davies says. "However, when our bioplastics facility is operating at full capacity, it only aligns with the starch from less than 0.2% of annual U.S. corn production, or less than 0.05% of global corn production. The corn oil, gluten feed and gluten meal markets for that 0.05% of the global corn crop remain unaffected."

Metabolix resins are used in a variety of products, including gift cards and pens, but the largest application is industrial compost bags sold in Europe. Metabolix produces and sells PHA resin pellets, called Mirel technology, to companies that turn them into compost bags. Mirel resins can be processed on the same equipment used to make petroleum-based plastics.

"Mirel is the fastest degrading bioplastic on the market," Peoples says. "It degrades within about 30 days in soil and 60 days if the bag ends up in the ocean. Its ability to degrade in the ocean

is important due to the plastic pollution in the oceans."

Prevent Pollution. In time, petroleum-based plastics photo-degrade with sunlight, breaking into smaller and smaller pieces. These particles remain suspended at or just below the surface of saltwater and become trapped by currents. The largest area where marine plastic pollution has accumulated is called the great Pacific garbage patch, and by some estimates, it covers 270,000 to more than 15 million square miles.

PHA products cost twice what petroleum-based products cost, and PLA plastics are 5% to 20% more expensive (depending on whether they’re compared with conventional plastics such as polystyrene, polyethylene terephthalate or PETE).

Cereplast’s Scheer explains that as the price of crude oil increases, bioplastics will become more cost competitive. As technology improves and the density of bioplastics declines, he says, they will be able to better compete with petro-based plastics.

Cereplast makes compostable and sustainable bio-based plastic products from corn, tapioca,

rice and bamboo. The company’s compostable resins are used to make single-use disposables and packaging including cups, straws, cutlery and bags, while its sustainable resins can replace as much as 95% of the petroleum in conventional plastics.

These durable plastics are used in consumer and electronic goods, as well as by the automotive, medical and construction industries.

Peoples says global demand for bioplastics is growing at about 20% a year. "People have been talking about bioplastics for the past couple of decades, but interest has increased substantially during the past couple of years now that there is a growing suite of materials available," he adds.

In 2010, global production capacity of bioplastics was 724,000 tons, which is equivalent to 1.96 million tons of corn, according to European Bioplastics, an organization that represents members from the agricultural feedstock, chemical and plastics industries, as well as industrial users and recycling companies. By 2015, global capacity is expected to reach 1.7 million tons, which is equivalent to 4.59 million tons of corn.

According to USDA’s latest supply and demand estimates, global corn production for the current crop year will exceed 880 million tons.

"Companies producing bioplastics and biochemicals need to find the right niche for their products and they need to be cost competitive," Grewall says. "If they are not cost competitive, bioplastics will always be a niche market.

Peoples’ Metabolix also produces biochemicals C-3 and C-4, which is a $10 billion global market.

Infinite Possibility. Multinational companies such as Coca-Cola, Frito-Lay, Danone and others have embraced bioplastics, says Davies of NatureWorks.

"How much of the plastics market can bioplastics take? With the big players interested in bio-based plastics and equally interested in seeing their products recycled or composted, the size of the bioplastics market is really the size of the plastics market," he says.

For more information about the bioplastics industry and how it might compete with ethanol, visit www.TopProducer-Online.com/bioplastics.

|

This bag of chips is packaged in a low-carbon-footprint bag using Ingeo resins. Photo: NatureWorks LLC |