Florida avocados face challenges with hot real estate market, disease pressure

Florida avocado growers have seen supply waiver with hot demand for South Florida real estate and from disease pressure. Shipments of Florida avocados totaled 36 million pounds in 2020, down 19% compared with 44.5 million pounds in 2019 and off 34% compared with 54.4 million pounds in 2015.

Florida’s avocado shipments accounted for 8% of U.S.-grow avocado supply in 2020, compared with 18% in 2019 and 16% in 2015. According to the U.S. Department of Agriculture’s National Agricultural Statistics Service, bearing acreage for Florida avocados has declined from 7,500 acres in 2008-09 to about 5,900 acres in 2017-18. In Florida, the USDA said most early season varieties of avocados are West Indian types, whereas midseason and late varieties are mostly Guatemalan-West Indian hybrids or Guatemalan types.

Florida’s avocado shipments accounted for 8% of U.S.-grow avocado supply in 2020, compared with 18% in 2019 and 16% in 2015. According to the U.S. Department of Agriculture’s National Agricultural Statistics Service, bearing acreage for Florida avocados has declined from 7,500 acres in 2008-09 to about 5,900 acres in 2017-18. In Florida, the USDA said most early season varieties of avocados are West Indian types, whereas midseason and late varieties are mostly Guatemalan-West Indian hybrids or Guatemalan types.

Commercial production, according to the USDA, is primarily in Miami-Dade and Collier counties.

Florida avocados have a lower fat content than those from other states and countries, are typically larger than avocados from California, and are available from June through the end of February, the USDA report said.

Supply outlook

Manuel Hevia, president of Homestead, Fla.-based M&M Farms, said his firm’s output should be similar to a year ago. “We will have a slower start, with slightly lower volumes, and then as the season progresses, we will have normal volumes,” Hevia said. He said the company will start the end of May or early June, with peak supply in July and August.

Hevia said foodservice demand is expected to come back strongly. “We are seeing (a jump in foodservice demand) with our other items and we expect no less with avocado,” he said.

Retailers, Hevia said, are looking for extended shelf life, and the company’s cooling and hydro-cooling deliver the longest shelf life possible. “Many years of experience have helped us tailor the process to maximize each variety’s potential,” he said. Hevia said new LED lighting has been installed under the packing line, which helps packing consistency and enhances safety for packing line personnel.

Overall industry output could be down again in 2021, said Peter Leifermann, vice president of sales and marketing for Homestead-based Brooks Tropicals. “Overall industry volume is expected to be less than last season, and this holds true across all growers,” he said. Peak supply is anticipated in July and possibly early August, he said.

Challenges

Leifermann said growers are facing the “perennial challenges of possible hurricanes, a red-hot real estate market, and ever-increasing labor/production costs.”

Perhaps most important of all, he said the ravages of the laurel wilt virus have taken a toll on the industry.

Hevia said the laurel wilt virus is having a severe impact on the industry, and urban sprawl also poses a big challenge for growers.

Marketing

Leifermann said Brooks Tropicals has been successful marketing the Slimcado brand tropical avocado, which he said is trusted across the continent.

“We rely on our partners across each industry segment who have proven flexible with sizing and understanding of the challenges we face,” he said.

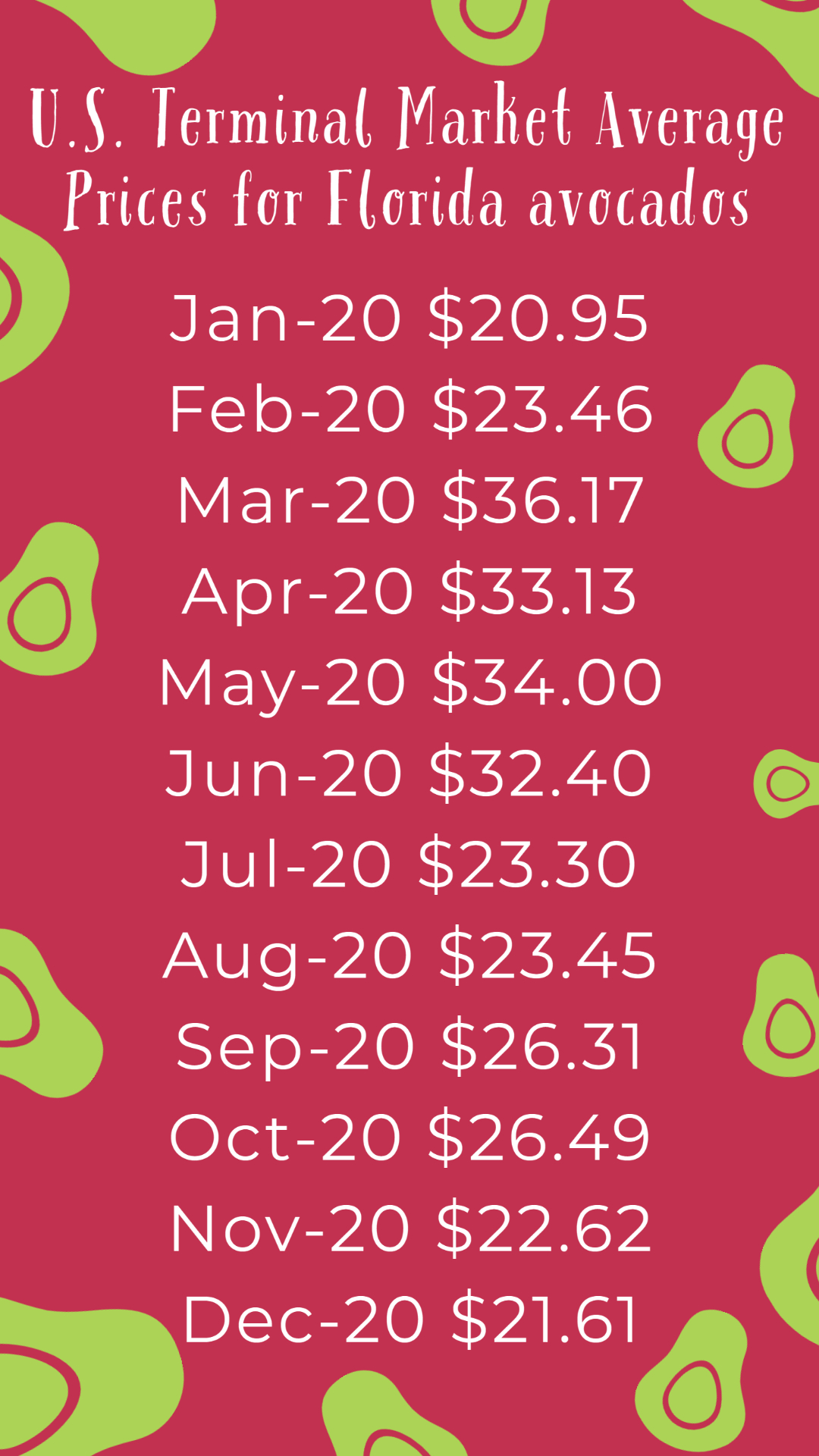

Last year, the USDA reported that top prices for Florida avocados at U.S. terminal markets peaked in March and April at $36.17 per carton in March and $33.13 per carton in April. The lowest average terminal market prices for Florida avocados in 2020, according to the USDA, was $20.95 per carton in January, followed by $21.61 per carton in December, and $22.61 in November.\