Mexican avocado imports contribute record $11.2B to U.S. economy, finds new report

Fueled by increasing demand, imports of Mexican Hass avocados continue to make powerful contributions to the U.S. and Mexican economies, according to a new report from Texas A&M University.

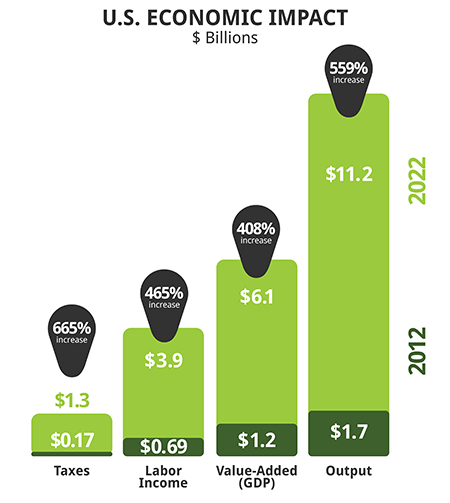

Based on economic contribution analysis conducted during the 2021-2022 growing season, Texas A&M found the impact to total U.S. output increased nearly 560% in the last 10 years, from $1.7 billion in 2012 to a record-breaking $11.2 billion in 2022. At the same time, the contribution to U.S. gross domestic product, value added, increased by nearly 410% from $1.2 billion in 2012 to $6.1 billion in fiscal year 2022.

Volume of Mexican avocados to the U.S. has also surged in recent years. Since 1997, the avocado supply from Mexico has jumped to more than 2 billion pounds annually, and more than 4 billion pounds in the last two years alone, according to the report.

“This positive economic growth is fueled by strong growth in U.S. demand for avocados and equally dramatic growth in the U.S. import economy. Mexico is the only region that can meet the U.S. demand year-round,” Alvaro Luque, CEO of Avocados From Mexico told The Packer. “In fact, U.S. per capita consumption of avocados has grown to more than nine pounds and we expect that number to continue to grow largely, in part [because] of Mexico’s ability to provide American consumers with avocados of the highest quality year-round.

“Additionally, knowing that we have a household penetration in the upper 60%, and the average is three avocados per family trip to the store, we still have opportunities to grow, and the sky is the limit,” he continued. “The industry is prepared for this continued growth, and in fact, this year will be a new record year in terms of volume of Mexican avocado imports.”

Economic contributions to both sides of the border

The report further found that the U.S. economy has benefited from the importation of Mexican Hass avocados in terms of labor and tax revenue — reaching $3.9 billion in labor income and $1.3 billion in taxes in 2022.

“Mexican avocado imports achieved record-breaking impact and drove significant growth on both sides of the U.S./Mexico border,” said Ana P Ambrosi, director of corporate communications, crisis and public relations for Avocados From Mexico, in a press briefing of the Texas A&M report. “We've always said that the Mexican avocado industry and [its] impact in the U.S is a win-win scenario for both the U.S. and Mexico.

“The economic growth from avocado imports not only provides jobs and economic output in the U.S., but it also creates a lot of jobs in Mexico,” she continued. “So, the new data is a testimony to the positive impact of the trade relationship between the U.S. and Mexico and its impact on their overall economies.”

Small avocado farmers in Mexico have also gained greater economic stability as a result of the trade relationship.

“This partnership has become an economic engine that not only supplies the growing demand for avocados in the U.S. but also provides opportunities for small avocado farmers in Mexico to generate sustainable economic growth, impacting thousands of families across the country,” said Luque. “The analysis shows domestic avocado growers have benefited from higher price points and a larger market for their products.

“In Mexico, avocado farming continues to be a feasible and reliable business venture as the Mexican avocado industry creates approximately 78,000 direct and permanent jobs and more than 300,000 indirect and seasonal jobs, with more than 30,000 growers and 74 packers,” he added.

What’s driving avocado import growth in the U.S.?

Like Luque, Ambrosi sees two main factors driving import growth: Dramatic growth in U.S. demand for avocados and equally dramatic growth in U.S. import supply.

Ambrosi attributes “the explosion in U.S. consumption of avocados” to a number of trends including the nation’s burgeoning Hispanic and Caribbean populations; increased use of avocados in restaurant and foodservice operations; and consumer interest in ethnic foods and foods that promote health.

Mexico’s proximity to the U.S. is also helping to drive fresh imports. Avocados typically arrive from Mexico to the U.S. in three to five days, said Ambrosi. Additionally, every avocado exported to the U.S. must meet strict dry matter testing requirements.

“The dry matter test ensures that avocados [imported to] the U.S. have the adequate oil percentage of 23%, which means more creaminess and more flavor,” she said.

And while the U.S. has long imported avocados year-round from Michoacán, Mexico, the recent trade expansion that allows for avocado imports from Jalisco has further enhanced Mexico’s ability to meet U.S. demand, said Ambrosi.

“We have 11 packinghouses already in the process of getting inspections and sending fruit to the U.S. There are more than 700 orchards that have already joined the program, and that will keep increasing,” she said. “And the good thing about Jalisco is that its strongest growing season is during the summer months, which is when the production in Michoacán usually decreases a little bit.”

The increased supply of fresh avocados from Mexico, is also good news for U.S. consumers. According to the report, nearly 90% of U.S. avocado imports come from Mexico.

“The Mexican avocado industry has been preparing for this kind of growth. The industry has been very responsible with planning and preparing for the future and we know we are an economic engine, as well as a win-win success story for both the U.S. and Mexico,” said Luque. “This [report] is a validation that we are on the right path.”

Avocados From Mexico is an Irving, Texas-based non-profit marketing organization that brings together the Mexican Hass Avocado Importers Association (MHAIA) and the Association of Avocado Exporting Producers and Packers of Mexico (APEAM) to promote the consumption of Mexican avocados in the U.S.