Lettuce markets soar to records, but prices should cool in December

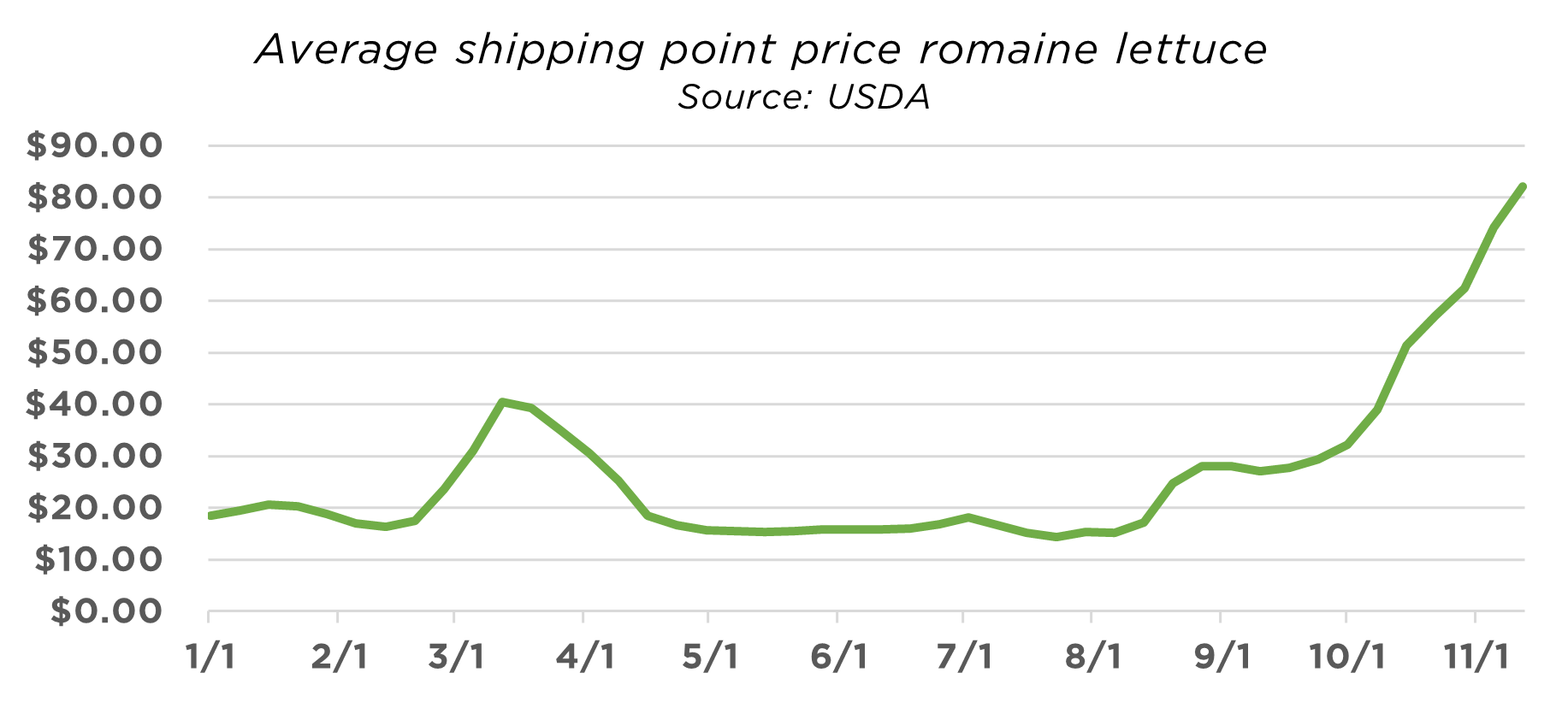

Pushed higher by a yield-robbing virus in the Salinas, Calif., region and limited volume from other growing regions, fob markets on romaine and iceberg lettuce soared to record highs of $100 per carton or more in early to mid-November.

The USDA reported average prices for romaine were $82 per carton in mid-November, up from $38 in early October and $28 per carton in early September.

Prices as high as $110 per carton were reached for Salinas area lettuce in November, Mike Chasen, owner of 68 Produce LLC, Salinas, Calif., said on Nov. 17.

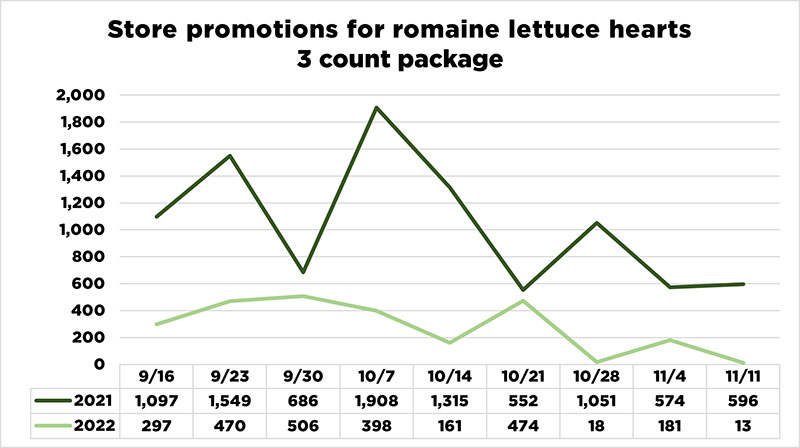

With the runup in fob prices, the retail promotion of lettuce virtually stopped. The USDA’s national retail report said only 36 supermarket stores promoted romaine lettuce with ad prices the week of Nov. 11, down from 1,588 stores advertising romaine on Oct. 14 and 9,796 stores promoting romaine with ads pricing on Aug. 26.

Shipping point prices were expected to ease Thanksgiving week but still remain at historically high levels for several weeks.

Salinas Valley lettuce was finished by mid-November, while supplies of lettuces were increasing from Yuma, Ariz., where growers haven’t reported problems with the virus.

Disease detail

The Grower Shipper Association of Central California said Nov. 10 that the shortfall in lettuce supply this fall has been largely attributed to crop damage associated with an aggressive pest and disease complex of Impatiens Necrotic Spot Virus (INSV) and soil-borne diseases.

Salinas lettuce fields were infected by INSV via thrips migrating from infected host plants, according to the association. Plants infected by INSV can have dark spotting and yellowing, which resembles the effects of sunburn on the leaves.

Another plant disease, Pythium wilt (PW), often accompanies INSV infections and causes the plant to wilt or collapse making this a complicated pest and disease issue for farmers, according to the group.

“In 2022, disease pressure was exacerbated by unseasonably warm weather stretches which caused prolonged stress on the plant making the lettuce more susceptible to disease impacts,” the group said.

The disease hit all the leaf lettuces and iceberg in the Salinas region, Chasen said.

‘It’s horrible to watch,” he said, noting that some growers were lucky to get a 10% yield out of fields hit with the virus. “You were watching all these crews go into fields, cutting every head and dropping 90% of them to the ground That’s a lot of labor for very little yield.”

The INSV disease has worsened over the last 10 years, said Joe Given, co-owner of Ed Given Inc. Salinas, Calif.

“This year was by far the worst,” he said, adding that growers planted less acreage because of a lack of irrigation water and the virus destroyed a high percentage of the acres that were planted. “It just kicked everyone in the fanny really hard.”

The Grower Shipper Association of Central California established an INSV/PW Task Force in 2021, with scientists, farm advisors and farmers working jointly to learn more about this disease complex and determine preventative and curative control methods, the group said. Varietal tolerance is a key area of focus, in addition to fighting INSV with thrips control through cultural practices.

Christopher Valadez, president of the association, said there is increasing research efforts to identify varieties resistant to both diseases, which often work in combination to destroy lettuce yields.

Big challenges remain, Valadez said, but the work of the association's task force has helped identify varieties that may offer some tolerance of the diseases for the late season period, which is the time that lettuce fields have been most susceptible to damage.

The Central California region accounts for more than half of U.S. annual lettuce shipments, Valadez said.

Given the learnings from this year, Valadez said growers should be in a better position heading into the 2023 season.

Another plant disease, Pythium wilt (PW), often accompanies INSV infections and causes the plant to wilt or collapse.

Transitions

Salinas, Calif-based Markon’s Fresh Crop Report for Nov. 20 noted that many suppliers of lettuce and tender leaf crops are done harvesting in the Salinas Valley and have started fall–winter production in the Arizona desert region. “The crops are healthy and there is no presence of the types of soil disease and virus pressure that ended the Salinas Valley season early,” the report said.

In Arizona’s desert region, Markon’s mid-November crop report said suppliers there were roughly five to seven days ahead on most crops, which has kept case weights for commodity packs “well below normal.”

“Expect light case weights for the next three to four weeks or longer given the cool forecast and suppliers being ahead of their harvest schedule season early,” the report said.

Pro*Act’s Nov. 16 market report said that value-added iceberg lettuce items were priced at an “all-time high.”

“At a minimum, value-added products will continue to increase during the month of November,” the report said. “The production in Huron is finished. Yuma has moderate availability at best but simply not enough to meet demand,” it continued. “Light weights, ribbing, and misshapen heads continue to be the main issues with this commodity.”

Cooling off?

Demand may cool somewhat during the week of Thanksgiving but lettuce prices may stay elevated for some time, Given said.

“I honestly think we're going to see some relief next [Thanksgiving] week,” Given said.

With Salinas Valley harvesting done and Santa Maria nearly finished, the focus is shifting to Yuma, where quality is reported to be good.

“I still think we'll see some high pricing, but you're not going to see the $85 to $100 [per carton] pricing. “We can easily see a $30 to $40 market, but that seems cheap compared to where we are now.”

Given said he has been in the business 43 years and never had seen $70 per carton lettuce before this year. The market blew past $70, $80, $90 and even topped $100, he said.

Even with fob lettuce prices above $80, Given said not all lettuce shipped was priced at that level, with some contract business likely held down close to about $35 per carton. He estimated that perhaps 75% to 80% of the lettuce shipments are probably being sold at around $35 per carton because shippers are trying to cover contracts first. Contract prices can escalate with rising fob markets but they can max out, depending on the wording in contracts, he said.

Besides U.S. supply, fairly light volumes of Mexican lettuce were crossing at McAllen, Texas, in mid-November at $55 to $65 per carton, he said.

USDA shipment data show total shipments were running well below year-ago levels.

Total U.S. romaine shipments totaled 28.33 million pounds the week Nov. 6-12, down 15% from 33.46 million pounds the same week last year. The Central California district, which includes Salinas, accounted for 58% of total romaine shipments in mid-November, down from 67% a year ago.

Arizona, on the other hand, accounted for 39% of total romaine shipments in mid-November, up from 25% a year ago.

Iceberg shipment numbers told a similar story.

Total iceberg lettuce shipments for the week of Nov. 6-12 totaled 34.9 million, down 19% from 42.6 million pounds the same week a year ago.

Central California shipments of iceberg lettuce the week of Nov. 6 accounted for 38% of total iceberg shipments, down from 72% of total shipments the same week last year. Arizona accounted for 32% of total shipments in mid-November, up from 18% of total shipments a year ago.

Inflation effect

Higher prices for all items during the holiday season could cause consumers to ease lettuce purchases, Given said.

“Whether it is 5%, 10% or 15%, everyone has got a little less money,” he said. “And now when you go into a supermarket, and you got to pay these astronomical prices for produce, especially look at our neighbors to the north in Canada, they have a 30% exchange rate on top of these high prices.”

Consumers may switch to other produce items such as cabbage, carrots, celery and broccoli, items that have a longer shelf life and lower prices than lettuce, Given said.

Mike Mauti, the managing partner for Ontario, Canada-based Execulytics Consulting, said he has not noticed any Canadian supermarkets taking lettuce off the shelf. However, he said supermarkets are adjusting pricing quite severely. “I saw romaine hearts selling for $12.99. I was shocked when I saw $7.99. But then $12.99 just floored me,” he said.

Mauti said he has heard of Canadian restaurants taking lettuce off their menus, including sandwich shops where lettuce is a staple.

He said greenhouse lettuce producers may benefit from the shortage, noting it is a great opportunity for those suppliers to grow household penetration. “It’s a good bet that this situation will leave them in a better market share position.”

Given said greenhouses and indoor facilities can’t begin to meet the immense demand for leafy greens in the U.S. and Canada.

“I think the greenhouses will be a viable option but a very small one,” he said.

The virus has not become a problem in the Yuma region so far and hopefully, that will remain the case, Given said.

Tony Alameda, managing partner at Topflavor Farms, San Juan Bautista, Calif., said the summer heat in the Yuma growing region is thought to destroy any virus present, whereas the disease can overwinter on weeds or ornamentals plant in the Salinas Valley. There is a two-week “no planting zone” starting on Dec. 7 in Salinas, which was traditionally to limit the lettuce mosaic virus, but that period hasn’t knocked down INSV.

Organic fields don't seem to show the effects of the virus any worse than conventional, and perhaps healthier soil can slow the effect of the virus, he said.

The disease seems to escalate in the Salinas Valley in mid-August, so some growers are phasing out of romaine, iceberg and green leaf by that time period.

“There is so much guesswork going on; we do not have the answers,” he said.

Alameda said it may take a couple of years to find varieties resistant to the virus, but he is optimistic the industry will solve the situation.

“We'll be right back on top, working better than ever. There is no doubt about it.”