Truck rates staying hot despite more equipment, seasonal decrease in shipments

OVERVIEW:

- Per-mile rates for refrigerated trucks are up 52%;

- The industry outlook on truck rates for the remainder of 2022 shows that rates will head even higher;

- DAT’s long-term forecast for spot-refrigerated truck rates predicts rates will increase in a range from 5 cents to 30 cents a mile higher by the end of the year;

- As deliveries are rushed to retailers, shippers had a preference to be “on time” rather than “in full.” That meant less-than-full truckloads were delivered in order to keep product moving;

- As compared to the previous, pre-pandemic times, spot market accounted for approx. 10% of freight. In November, spot market rates were sitting at about 25%;

- If fuel costs approach 30% of truckers’ revenue, there is expected to be a rise in bankruptcies and exodus from the industry;

- Tight freight conditions are expected to persist through much of the year.

Putting upward pressure on delivered produce prices, refrigerated truck rates have soared to nearly $5 per mile in early February, according to a survey by the USDA.

The $4.97 per-mile rate in early February for refrigerated trucks is up 52% from $3.27 per mile the same time last year and up nearly 70% compared with $2.93 per mile two years ago, according to the USDA.

Put another way, truck rates from Washington’s Yakima Valley to New York in early February were in a range from $11,000 to $13,000 per truck, up from $7,600 to $8,600 the same time a year ago, according to the USDA. For each 40-pound carton of apples shipped from Washington to New York, the freight cost per carton rose from $8.10 per carton a year ago to $12 per carton now.

The higher transportation costs were reflected in apple pricing. Size 72s Washington red delicious apples were trading at New York’s Hunts Point Wholesale Market at $42 to $45 per carton on Feb. 8, up from $40 per carton the same time a year ago.

OUTLOOK

The industry outlook on truck rates for the balance of 2022 reflects the belief by most that rates will head even higher.

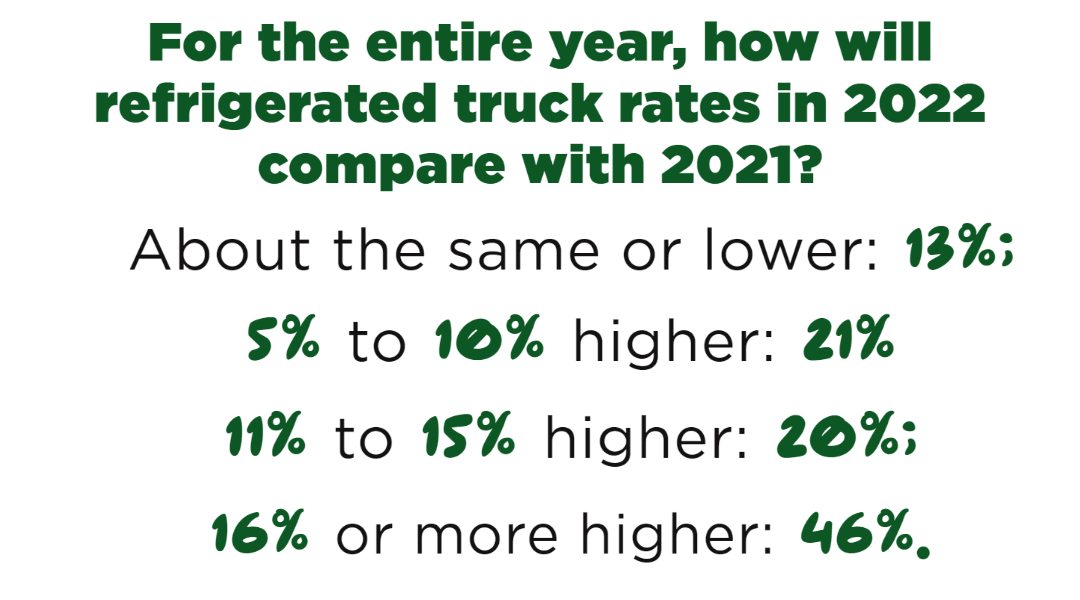

According to a poll in the LinkedIn Fresh Produce Industry Discussion Group, nearly 80 people voting answered the questions:

Nearly half of those voting predicted truck prices would increase 16% or more in 2022 compared with last year.

ROLLER COASTER

Since the pandemic began, it has been a wild ride for refrigerated truck rates.

Influential factors in the temperature-controlled market are the highly fragmented, temperature-controlled capacity base and the fact that temperature-controlled commodities are less shelf-stable than their dry counterparts, said Mark Petersen, vice president of transportation for C.H. Robinson, Eden Prairie, Minn.

“Delays and disruptions, which are more common in a disrupted market, lead to an immediate next-shipment impact, creating a wave of potential waste and inefficiency,” Petersen said. “Compounding this issue, temperature-control carriers generally have lower trailer-to-tractor ratios than traditional dry fleets due to the higher cost of equipment.” That means that any waste, such as detention or dwell time causes a direct impact to supply-and-demand imbalance, forcing an increase in market price, he said.

Read related: New CDL requirements could cost you up to $8,500 and weeks of training

“This is, in part, why it’s so important to have a partner with access to a broad network of carriers,” Petersen said.

Elevated dry van rates are also a factor in refrigerated truck prices. “As dry van rates have increased, the market has drawn some temp-controlled carriers to shift to dry, reinforcing the higher rates to keep carriers hauling temp-controlled freight,” he said.

Petersen said that, while challenges with temperature-control commodities will likely continue, C.H. Robinson sees a growing potential for a return to more traditional seasonal supply-and-demand cycles.

“As always in the produce supply chain, weather-related disruptions challenge supply chains, particularly when they line up with higher consumer demand around events like the summer grilling season,” he said.

In general, market disruptions have supported a shorter contract cycle and spikes in the spot market.

Read related: Supply chain gridlock causes $2.1B loss to California agriculture

“For retailers who find themselves in the spot market more often these days, we launched new technology called Market Rate IQ that’s the first of its kind in the industry,” he said. “ It gives them the ability to see the patterns in their spot freight and show them what changes they could make to save money.”

Petersen said using technology to gain visibility into real-time risks is essential to limit waste and control costs.

TRENDING UP

Refrigerated truck rates typically plunge in January because of seasonally lower fruit and vegetable volume in the U.S., said Dean Croke, principal analyst for truckload freight marketplace DAT Solutions.

This year, refrigerated truck rates have been flat in January, and spot rates for refrigerated loads, excluding fuel, were $3.07 per mile at the end of the month. That is 82 cents per mile higher than the same week last year.

Contract rates have also risen, increasing 39 cents a mile compared with a year ago, he said.

Anything above $3 per mile is considered “new territory” for refrigerated truck rates, and Croke said the current seven-day rolling spot market average of $3.07 (excluding fuel) was about $1.22 per mile higher than the five-year average for that week.

Read related: 2022 brings big challenges in supply chain, logistics, trucking

Spot rates for refrigerated loads typically climb between March the peak domestic shipping season in the summer. This year, rates may stay elevated throughout the year, Croke said.

DAT’s long-term forecast for spot-refrigerated truck rates predicts rates will increase in a range from 5 cents to 30 cents a mile higher by the end of the year.

Higher freight rates in the past year have attracted more equipment and drivers to the industry, but Croke said that other constraints are keeping rates elevated.

The truck industry has added something like 230,000 power units in the last year, according to federal statistics of new carrier authorizations. As of November, the U.S. had a total of about 4.5 million trucks for hire in private fleets, Croke said.

“We’ve added capacity, but I think what's happened is the volume of freight moving in the spot market has doubled in the last year,” he said. For 2021, the total number of loads moved was essentially flat, but the loads moving under contract dropped 14% and the loads moving on the spot market increased 14%.

The COVID-19 pandemic of 2020 created supply chain shortages that also contributed a massive shift to the spot freight market, rather than contracts, Croke said.

Demand was increasing but supplies were limited by the pandemic bottlenecks, creating an imbalance in some shipping lanes and creating an urgency to acquire transportation through the spot market.

“What that meant was that capacity wasn't where it should be, or predicted to be, and shippers had to go to the spot market,” he said.

As they rushed to deliver orders to retailers, shippers had a preference to be “on time” rather than “in full.” That meant less-than-full truckloads were delivered in order to keep product moving.

In pre-pandemic times, Croke said about 10% of all freight moved on the spot market, and last November, it was 25% spot market and 75% contract. Now, he said, that ratio may be about 20% spot market and 80% contract.

In pre-pandemic times, Croke said about 10% of all freight moved on the spot market, and last November, it was 25% spot market and 75% contract. Now, he said, that ratio may be about 20% spot market and 80% contract.

“You could safely say the volumes moving on the spot market have doubled during the pandemic,” he said.

The driver shortage for trucks is misleading, he said. Instead of looking at truck capacity alone, Croke said the labor shortages at the grower-shippers and warehouses have held back deliveries.

“Every grower and every warehouse have struggled to get labor,” he said.

Even though there are thousands more trucks in the market, truck velocity has slowed.

When growers or distributors have fewer dock doors open and fewer warehouse workers available, trucks will spend longer times loading and unloading.

“I’ve been saying for six months that we don’t have a driver shortage, we have a driver velocity/throughput issue,” he said. More trucks are entering the market, but they’re cycling through markets at a slower speed, he said. “I think we have plenty of trucks, but they are not moving fast enough; they are spending more time loading and unloading. There is capacity, it's just not burning through markets quick enough because of all of the imbalance we've got because of the pandemic labor shortages and supply chain disruptions, all those things that are still persisting.”

The spot market typically declines over time as elevated contract rates draw volume out of the spot market. “That’s why spot market rates should cool as contract rates remain elevated year over year,” Croke said.

Demand will eventually readjust and there will be more equilibrium in the market, but Croke said tight freight conditions are expected to persist through much of the year.

Even though fuel costs are high for truckers, they only represent about 25% of their revenue, which is a fairly standard ratio. If fuel costs approach 30% of truckers’ revenue, there is expected to be a rise in bankruptcies and exodus from the industry.

Croke said the truck protests in Canada about the vaccine mandate are increasing rates for some north-south lanes. “Of the 160,000 cross-border drives, about three quarters are Canadian,” he said, noting that “because of the protests up there in Canada, you've got fewer trucks coming across the border, and it has meant there's been a tightening of capacity in those northbound lanes.”

Freight rates appear to be quite strong, despite increasing numbers of trucks and drivers coming on to the market, said Dale Watkins, regulatory affairs manager at the Owner-Operator Independent Drivers Association, or OOIDA.

“I think, on the economic side, I think (drivers) are in a good place,” he said, but the OOIDA does not believe there is a driver shortage.

“There's a record number of commercial driver’s license holders,” he said. “There are people available, you just need to pay them better; most of the ones that are complaining the loudest are the bigger carriers with the highest turnover.”

Watkins said there are some reports that the disruptive protests in Canada, linked to vaccination requirements for drivers moving cross-border commerce, could spread to the U.S.

“As to whether that will really happen, who knows?” Watkins said. “It depends on what our president will do and if he will pull back on these mandates or not.”

There may not be any quick relief to high freight rates for refrigerated trucks, said Seth Konkle, general manager at the Indianapolis, Ind.-based transportation provider Scotlynn Group.

“We’re hoping that (the rates) at least stabilize and stop the upward trend,” he said, noting that the amount of equipment available is slowly coming back.

However, long loading and unloading times have slowed trucks, he said.

Another industry leader said that the firm rate outlook shows no sign of backing down.

"We are forecasting refrigerated truck rates will remain elevated throughout the remainder of 2022," said John Tonsil Jr., co-owner of Avondale, Pa.-based Gorilla Logistics. "Shippers have become accustomed to it and overall market conditions show no sign of letting up."

As the U.S. loosens its COVID-19 restrictions, he said he foresees additional increases in consumer spending resulting in continued high refrigerated truck rates to shippers.

"Working with committed transportation partners will offer the best chance to mitigate some of the increases but the booming demand for products will continue to reflect in refrigerated truck rates," Tonsil said.

Related: PODCAST: Shay Myers on freight issues, retail updates, social media

“I think a lot of shippers and receivers have gotten a lot better about being flexible and being quicker,” he said. However, because of labor shortages, some suppliers and receivers are still not able to load and unload trucks, and drivers are having to wait as much as a day to get unloaded.

“(Delays) are definitely restricting capacity even more than it already is,” Konkle said.

Some shippers want to increase contract pricing, but Konkle said that the carrier is reluctant to do year-long commitments because of the potential volatility of the market.

“We're a little bit more willing to do three to three- or six-month commitments, which ultimately is going to benefit the shippers because, at some point, there's going to be some relief in capacity and the rates will soften up,” he said. “Really, until COVID is completely behind us, we’re trying to avoid long-term commitments as much as possible.”