Retail produce sales remain elevated, but growth slows

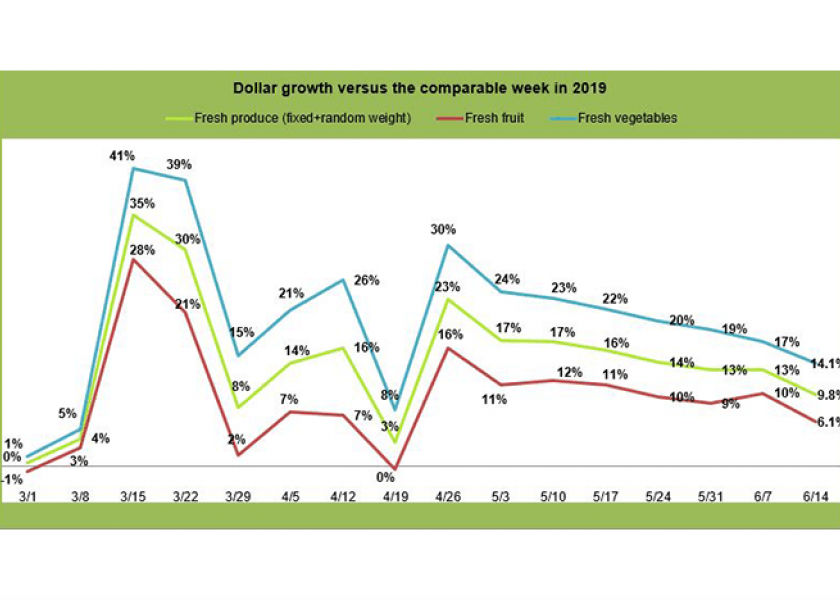

Fresh produce dollar sales growth fell below 10% for the first time in nearly two months as the timing of Father’s Day produced unfavorable sales comparisons for some items.

For the week ending June 14, fresh produce sales were 9.8% higher than the same week in 2019, according to IRI. Vegetable sales were up 14.1%, fruit sales up 6.1%.

Sales growth had been slowing gradually throughout the month of May, from 17% the week ending May 3 to 13% the week ending May 31.

The second week of June saw lower sales for summer staples including melons (-8.2%), grapes (-10.8%), peaches (-4.9%) and corn (-20.8%).

“It is important to keep in mind that Father’s Day 2019 fell on June 16, so sales gains for this week had to go up against last year’s holiday bump,” Jonna Parker, team lead for fresh for IRI, said in the release. “With Father’s Day being a big grilling holiday, we would typically see big spikes in things like corn, melon and the fixings for fruit platters and salad to go along with the dad’s favorites on the grill.”

Joe Watson, vice president of membership and engagement for the Produce Marketing Association, noted that produce sales appear to be in a more consistent trend in the last month or so but that inflation is also rising for fresh, canned and frozen produce.

“While the two big summer holidays, Father’s Day and Fourth of July, have the ability to significantly boost produce sales at retail, states are continuing to open more widely,” Watson said in the release. “It will be interesting to see how consumers re-engage, and we will be watching demand on key items. Retailers are gearing up for the strong summer season, with fruit taking center stage now through Labor Day.”

In the meantime, vegetables continue to outperform fruit in year-over-year growth. All but two items on the top 10 list for the category saw double-digit gains over 2019, with tomatoes (24.3%), peppers (24.2%), mushrooms (23.4%) and cucumbers (21.6%) experiencing the largest increases.

“More than three months since the two biggest panic buying weeks in the history of grocery retailing, vegetable gains are still in the mid-teens versus year ago, whereas the fruit performance is much more up and down,” Parker said in the release. “Gains in vegetables illustrate that consumers are still engaging in a lot more at-home meal occasions, and the challenge now becomes how to keep those meals fun and varied. Provide tips and recipes on social media and in-store to help consumers with their meal lineup fatigue.”

Oranges continued to lead the fruit category with staggering 63.9% growth compared to the same week in 2019, and cherries recorded a 45.7% increase, per IRI. Berry sales were 10.6% higher than last year, and avocados were 9.9% higher. The other top 10 fruit items saw much smaller increases over 2019 or saw sales lower than 2019 levels.

“Looking at absolute dollar gains shows how quickly things change from week to week,” Watson said in the release. “In the past two weeks, cherries jumped to the top in absolute dollar gains, but this week berries reclaimed their top three position, with cherries in fourth. Oranges climbed a few spots to fifth, and potatoes dropped out of the top five for the first time since the onset of coronavirus in early March. Cucumbers are a newcomer to the top 10 produce items in absolute dollar gain, pushing onions off the list.”

It remains to be seen how far above the normal benchmark produce sales will remain as more businesses open across the U.S., including many restaurants.

“Given the disproportionate impact of the virus and economic collapse over the past three months, it is highly likely that the recovery will be highly disproportionate as well,” Anne-Marie Roerink, principal of 210 Analytics, wrote in the release. “The local speed of economic recovery along with any levels of latent social anxiety to re-engage with foodservice will drive the demand at retail in the upcoming weeks.