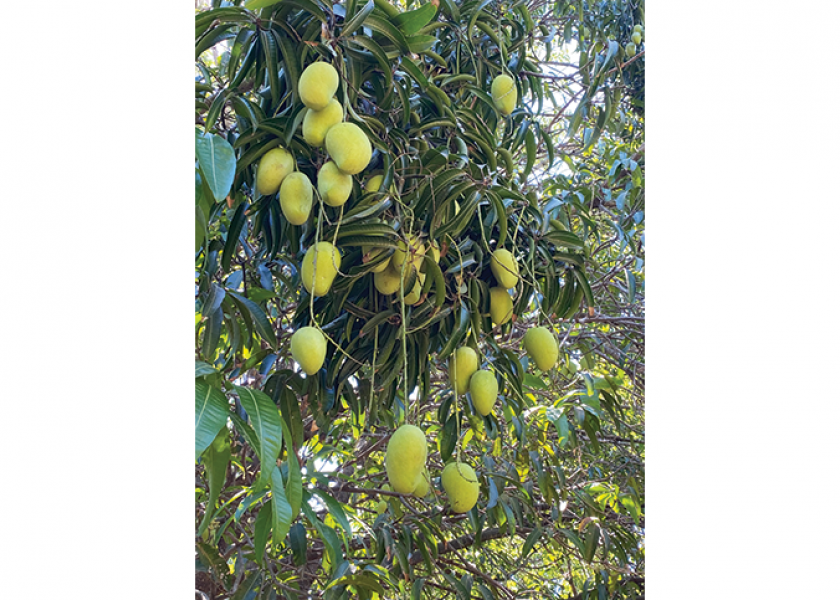

Mexico gets ready to dominate mango market

Mexico’s share of the U.S. mango market will increase dramatically through the spring and into the summer.

Peru’s mango shipments to the U.S. peaked at the end of January and its season is expected to wind down starting in mid-March, according to Manuel Michel, executive director of the National Mango Board.

Importers note that Peru’s mango volumes have been heavy this year and delayed some round mango shipments from Mexico.

“Overall Peru’s volume to the U.S. will increase by approximately 61% compared to last year, from approximately 12 million boxes to 19.3 million boxes (4 kilograms/box),” Michel said in an e-mail.

Mexico’s eventual volume will be much bigger than Peru, he said.

Mexican mango shipments to the U.S. have increased from just 277,000 metric tons in 2015 to 368,000 metric tons in 2019. Mexican mango shipments to the U.S. in 2019 were nearly 5% higher than 2018 shipments, according to the U.S. Department of Agriculture.

In 2019, Mexico mango shipments to the U.S. reached their peak in July, when 18% of Mexico’s annual volume was shipped. After July, top volume months for Mexican mango shipments to the U.S. were June (16%), May (15%), August (15%) and April (12%).

With per capita mango availability rising from about half a pound in 1990 to more than three pounds in 2017, U.S. distributors say there is still room to increase imports of Mexican mangoes.

Mexico accounts for about two-thirds of total U.S. mango imports, according to USDA statistics. Measured by value, 2019 U.S. imports of Mexican mangoes totaled $351 million, or about 61% of the total value of U.S. mango imports.

Track record

In 2019, Mexico exported 82 million boxes of mangoes to the U.S., which Michel said was an increase of 5% compared to the previous year.

“This year their season has started at the same pace as last year and their quarter one volumes are expected to be similar to last year with approximately 10 million boxes,” he said.

Volume projections for quarter are expected to be similar to last year, except that the Michoacan season is delayed by two to three weeks, which will shift its volumes from March to April, he said.

Market outlook

The USDA reported f.o.b. prices in south Texas for Mexican ataulfo mangoes on Feb. 19 were $9-10 per carton for size 12s.

“Everybody is starting off a little light right now, just trying to gauge the market on ataulfo mangoes,” said Mario Cardenas, sales manager for London Fruit, Pharr, Texas.

In South Florida, the USDA reported f.o.b. prices for kent mangoes from Peru were $3-4 per carton on Feb. 19, down from about $7-8 per carton the same time a year ago.

Weather has been favorable for Mexican mango development, said Chris Ciruli, chief operating officer of Nogales, Ariz.-based Ciruli Bros. The company was recording its first arrivals of ataulfo (branded Champagne by Ciruli) mangoes from Chiapas to south Texas and Nogales, Ariz.

The company expects a promotable supply of yellow mangoes from Chiapas in March that will continue for about a month, which will lead to good promotion opportunities for Easter in the first part of April, Ciruli said.

Volume of Mexican yellow mangoes was expected to be about 15% higher than a year ago in March. For tommy atkins mangoes, the national market in Mexico was outpacing the U.S. market in mid-February, which is resulting in more fruit remaining south of the border.

Round mango supplies and promotions pick up significantly by early April, he said.

With Mexican mango imports recently growing 8% to 10% per year, Ciruli expects Ciruli Bros. will see higher double-digit growth in mango volume this year.

Peru’s kent mangoes don’t compete for the same consumers as Mexico’s ataulfo variety, said Andres Ocampo, director of operations for HLB Specialties, Pompano Beach, Fla., which leaves room for some overlap in seasons.

Overall mango demand continues to grow both at retail and foodservice operations, he said.

“Mangoes are becoming more of a mainstream item, like pineapple was a few years ago,” he said.

Ocampo said the seasonal window for Mexican mangoes seems to be increasing along with volume from year to year.

“Mexico keeps expanding before and after (the traditional season), so the window for the rest of the market gets squeezed,” he said.

Mexico’s ataulfo mangoes started in late January, a bit later compared with a year ago, said David Ponce, procurement director of Amazon Produce, Vineland, N.J.

By mid-February, USDA statistics show Mexico accounted for 30% of total U.S. mango volume, with Peru accounting for about 70%.

Ponce said most Mexican honey or ataulfo mangoes are running to bigger sizes, mainly 14s, 16s and 18s.

“There are very few small fruit as of right now,” he said in mid-February.

Most ataulfo mangoes were from Oaxaca and Chiapas, he said, with increasing volume from both states.

“The first flowering (harvest from) Chiapas the first week of February was not that good because we had some rain during the flowering season. But now (harvest) has started the second flower, which is a lot better in terms of terms of quality,” he said.

The peak availability of ataulfo or honey mangoes is April, with good availability from mid-February through most of June. Limited volume of ataulfo mangoes will continue through July, he said.

While tommy atkins mangoes are starting to become available from production regions, Ponce said heavy supply from Peru has caused some marketers to temporarily hold off in sending fruit to the U.S.

“Some growers are selling to the local market and others are just holding fruit on the tree because the quality is (strong),” he said.

Volume of tommy atkins sent to the U.S. market will increase by mid-March.

“We’re going to start seeing a little bit of more tommy atkins coming into the U.S. market, although it’s not very interesting for (growers) because we are used to seeing a higher market right now going into March on tommy atkins and kents,” he said.

Other Mexican mango producing regions include the states of Michoacán, Sinaloa, Nayarit, Jalisco and Veracruz.

Growth path

Ponce said that increased volume of mangoes is expected from Sinaloa this year after weather setbacks have limited volumes the past two seasons. He said Amazon Produce expects to grow Mexican mango volume by 10% to 15% in 2020.

Ponce said Mexico will offer greater availability of all mangoes by mid-April.

“There is going to be great (supply) for promoting for Cinco de Mayo,” he said.

Organic mango volume from Mexico is increasing, though Ponce said the intensity for organic fruit seems to have slowed the past couple of years, especially when conventional mangoes have been in good supply.

Even so, Ponce said Amazon Produce is working on a year-round organic program, with supply from Mexico, Peru and Ecuador.

Ponce said fresh-cut mango demand has increased sales to processors who distribute fresh-cut mangoes.

Related content:

Mango importers hustle to meet Cinco de Mayo demand

Mexican mango deal gets off to a slow start