Sustainability Insights: Retailers aim to do the right thing

Editor's Note: The following report is from The Packer’s Sustainability Insights 2023, which aims to better understand growers', retailers' and consumers' involvement and market behaviors surrounding packaging, labeling, food waste, and sustainability. The survey was designed by Trust in Food — Farm Journal’s sustainable ag division — and conducted and analyzed by Farm Journal Marketing Research and Insights.

Driven by a desire to do the “responsible thing,” sustainability is a priority for most food retailers, finds The Packer’s 2023 Sustainability Insights survey.

Fifty-one retailers responded to the web-based quantitative survey fielded March 20-27, 2023. The majority, or 84%, of respondents identified as independent grocers. Retailers from corporately owned regional chains represented 4% and national chains 2% of respondents. Ten percent of respondents identified as “other.”

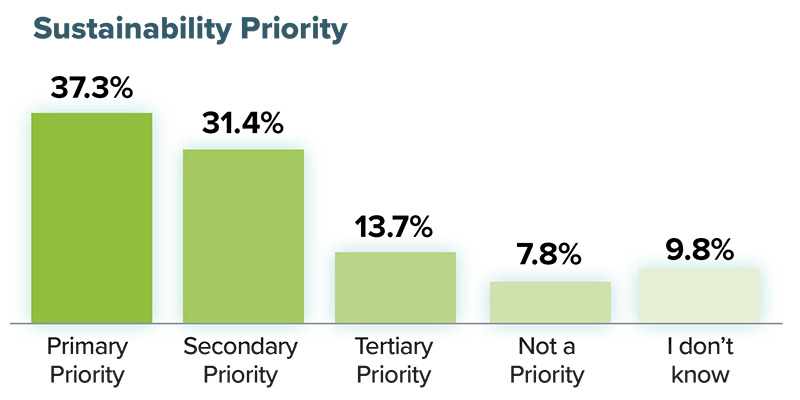

According to the survey, the majority of food retailers see sustainability as a priority in their businesses, with 37% indicating it is a “primary priority” and 31% saying it is a “secondary priority.” Only about 8% of survey respondents said sustainability was not a priority.

What does “sustainability” mean to food retailers?

“Organic” and “environment” are the words most frequently associated with sustainability, the survey found.

When it comes to motivation for embracing sustainable practices, 37% of retailers surveyed said their top reason for implementing sustainable practices was because they “feel it is the responsible thing to do.” The second-biggest driver was to reduce food waste, with 33% of respondents indicating so, while saving money was a key driver for 27% of retailers.

Addressing climate change, improving human health, and improving water quality and/or using water more efficiently were tied for fourth, with 22% of respondents indicating these as the driving factors in embracing sustainable practices.

Leader of the pack

Why do retailers seek sustainability? The survey asked retailers to rank various reasons behind implementing a new sustainability practice in their operations in order of importance. The majority of retailers indicated that positioning their company as a leader in the industry is a key driver when implementing new sustainability practices.

Making progress toward the company’s stated sustainability goals and positioning the company to win business with customers are also considered important drivers in the adoption of new sustainable practices.

Where are retailers placing their sustainability focus? Reducing carbon emissions (43%) and using sustainable produce packaging (43%) were tied for the top sustainability initiatives, when retailers were asked which sustainable practices they have implemented.

The cost of climate change

Interestingly, the survey revealed somewhat inconsistent feedback on climate change and the reduction of carbon emissions. As carbon dioxide is the principal greenhouse gas contributing to global warming, it’s not surprising that the survey found reducing carbon emissions is one of the top sustainability issues tackled by retailers.

However, only 14% of respondents said that addressing climate change was “extremely important” to their sustainability priorities and more, or 20%, said climate change was “not at all important” to their business. This may suggest the link between climate change and carbon emissions is not as explicit for retailers as it is for growers, for whom The Packer’s 2023 Sustainability Insights survey found climate change remains a top concern.

Half of retailers reported having public goals relating to reducing greenhouse gases. Of those who do, the majority said they have plans to announce those reduction goals within two years. Of those who don’t have public goals on the reduction of greenhouse gases, only 18% say they will have targets in the future.

When retailers were asked if they purchase carbon credits, most, or 74%, responded “no.”

Around a quarter indicated they intend to do so in the future. Almost a third of respondents who don’t currently purchase carbon credits said they have plans to do so in the future.

While the survey found that addressing climate change isn’t a top priority for the majority of retailers, it also found that 45% of retailers are most concerned that climate change will affect their supply chain and add additional expenses to their business. Thirty-seven percent of retailers surveyed fear the impact of climate change on seasonal availability and related price increases.

On a related note, the survey found that cost was the main prohibiting factor for retailers when deciding whether to adopt sustainability initiatives. What’s more, few retailers think they are fairly compensated for costs incurred by implementing sustainability initiatives to their retail business.

When asked who is responsible for leading and promoting sustainability practices and policies, only 16% of retailers surveyed think they are responsible. Twenty-five percent of retailer respondents said they think the responsibility lies with growers, 22% said consumers and 20% said the USDA.

Unpacking sustainable packaging solutions

If The Packer’s 2023 Sustainability Insights survey is an indication, retailers need more education and information on sustainable packaging if they are going to fully embrace more environmentally friendly solutions.

When asked, “What does sustainable packaging mean to you?” Retailers indicated reusable (61%) and biodegradable (61%) as top sustainable packaging solutions. Recyclable (53%), made from recycled materials (45%), compostable (39%) and packaging that protects the product to reduce food waste (37%) are also sustainable packaging terms that register with retailers.

But the majority of retailers, or 55%, said they don’t have the necessary information needed to deliver sustainable packaging. They indicated wanting more information about the material types and recyclability of packaging options.

Most retailer respondents to The Packer’s 2023 Sustainability Insights survey also indicated a preference of practical over pretty when it comes to sustainable packaging design. Sixty percent of retailers said they either “completely agree” or “agree” that they would trade off packaging graphics and aesthetics to have recyclable packaging.

But like the perceived barrier of entry for other sustainability programs, the costs associated with greener packaging may have some retailers hesitating to adopt.

The Packer’s survey found that over 80% of retailers think consumers are only willing to pay 10% or less for sustainably packaged goods. No survey respondents answered that consumers would pay 21% or more for sustainable packaging.

Food fight: Retailers seek to reduce their waste line

The Packer’s 2023 Sustainability Insights survey found that reducing food waste was the second-most popular retailer response when asked about reasons for implementing sustainable practices.

But while reducing food waste was listed as a top reason for implementing sustainability practices, just over one-third of retailers report having reduction goals in place. That said, over half of businesses surveyed (51%) have donated food that would otherwise be wasted; 47% have partnered with vendors who repurpose food into animal feed, compost, etc.; 43% have created value-added products to make fuller use of all produce grown; and 31% help growers in their supply chain with on-farm storage.

And while most retailers (61%) say they don’t have reduction goals, when asked to list their food waste reduction goals or targets, retailers had this to say as to why they engage in food waste reduction efforts:

- “Donate excess and waste to proper channels.”

- “Help renew and reuse. Limit buying, so it doesn’t go to waste.”

- “Less than 10% food waste.”

- “Cut by 5%.”

Related to food waste reduction, nearly 1 in 5 retailers surveyed said they plan to invest in shelf-life extension technology in 2023. Meanwhile, 45% of respondents indicated they plan to explore shelf-life extension technology down the road, but not this year.

The shape of water

The overwhelming majority of retailers, or 85%, in The Packer’s 2023 Sustainability Insights survey have concerns about access to sufficient water supplies for crop production.

When asked what they are doing to address water shortage concerns, retailers cited exploring different regional produce sourcing to address concerns most often. Changing the mix of fresh produce offered to limit exposure to water shortages and engaging policymakers were other top efforts.

As to their own water reduction goals, only a quarter of retailers surveyed have set such goals. Thirty-one percent said while they don’t currently have water reduction goals in place, they plan to in the future.