What about the orange consumer?

While we’re all produce operators in some capacity, we are all consumers, or potential consumers, of the products we sell. So, the question of the day is this: When was the last time you tried a navel orange? I suspect, for most of us in the industry, the answer will be some time in the not-too-distant past.

But for nearly half of the general grocery-shopping public, the answer is sometime in the last three months, according to recent Execulytics consumer research. That level of popularity places oranges as a top five fruit for household penetration, rubbing elbows with the likes of apples, bananas, strawberries and grapes.

Putting our produce hat back on, it becomes apparent that oranges command a high level of care in the produce departments across North America.

Now what?

In the consumer research game, learning that oranges have a high household penetration is referred to as “The what?” Going one step further, the conclusion that oranges command a high level of care is the “So what?” But answering these questions does us little good unless we can also answer, “Now what?”

And for that answer, we need to know what “a high level of care” means to an orange consumer if we want our retail location to be the first choice for that valuable customer. I have a sneaking suspicion that most people will purchase a whole lot of other stuff wherever they choose to purchase their oranges.

Price or quality

To get to “Now what?” it is important to understand what makes an orange consumer tick: Are they more concerned about price or quality?

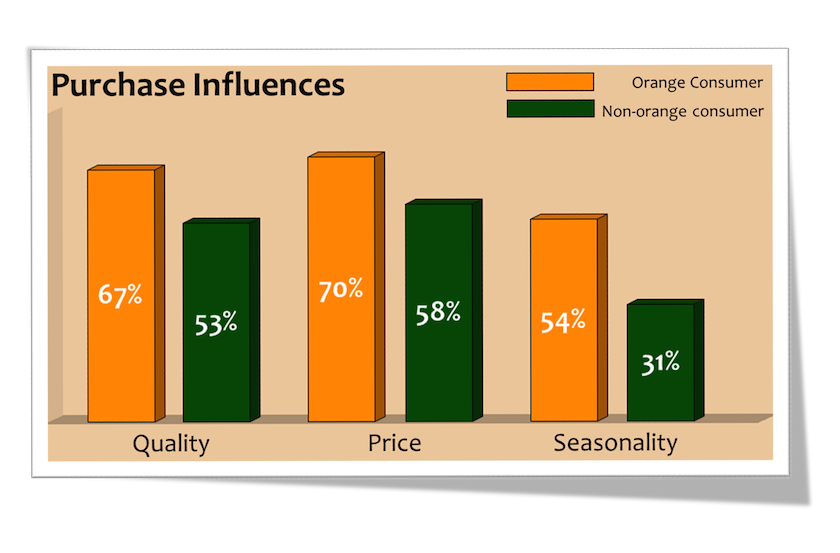

This is where the orange consumer throws us a curveball. Those who purchased oranges in the last three months are 26% more likely to be influenced by quality than the non-orange crowd and 21% more likely to be influenced by price, according to Execulytics consumer research.

Sounds simple. Also, orange consumers are 74% more likely to be influenced by concerns of seasonality. As a top-five fruit, shopkeepers should take great care when creating an orange offer. Great care can be defined as a high-quality, low-priced, in-season orange.

Great, how do we execute on this intelligence?

Fancy, but smaller

In North America, in-season oranges are generally available in the winter and spring seasons, and grown domestically in the U.S. If consumers are demanding U.S.-grown, high-quality oranges, then a “high level of care” could simply be to give the customers exactly what they are demanding.

Learn more: Oranges, the commodity

Try asking a supplier for a grade of orange that is fancier than fancy. It is likely that the best of the best is set aside and sold as a premium grade. But premium grades sell for premium prices, so, to satisfy the price-conscious part of the orange customer’s psyche, instead of carrying a 48- or 56-count navel orange, try sizing down to a 72-count.

The last four editions of the Produce Almanac show 72-count navel oranges to be less expensive than either of the two larger sizes. That’s top quality, at a competitive price — just like the orange consumer told us.

The orange consumer

But just who is this orange customer demanding such things?

It’s probably better to view this discerning customer as half the population — the half who buys oranges. And we should consider ourselves lucky that this half of the population is telling us the keys to their grocery wallet (at least when it comes to fruit and veg).

I wonder what customers of the other top-five fruits would tell us. We’ll have to leave that for another day.

____________________

Mike Mauti is managing partner of Execulytics Consulting, with 25 years in the produce business focusing on retail and consumers.